Conagra Brands Inc put better-than-expected first quarter sales down to heavy ordering by retailers worried about the durability of supply chains in the months ahead as a second wave of coronavirus cases takes hold.

Shares in the foodstuffs maker dipped as much as 3% before recovering after chief financial officer David Marberger warned that, while stocking up by its big retail customers had boosted sales growth by 6 full percentage points, ordering was likely to now ease.

Chief executive Sean Connolly added that many retailers had already stocked up against the end-of-year holiday period when they worry that coronavirus cases will spur new lockdowns and economic trouble that will hurt supplies of goods.

Conagra and its retail customers have boomed since February as coronavirus-induced at-home eating boosted demand for all kinds of foods, including the frozen vegetables, snacks and ready-to-eat meals the Chicago-based firm is best known for.

'Seriously Depleted'

Retailers were "seriously depleted" in the three months to Aug. 30, Marberger told a call with analysts. Restocking was so strong, the company increased third-party manufacturing to meet orders for its Birds Eye frozen vegetables, it said.

"Between manufacturing capacity overall and retailer inventories being light... we're still in catch-up mode," Connolly said.

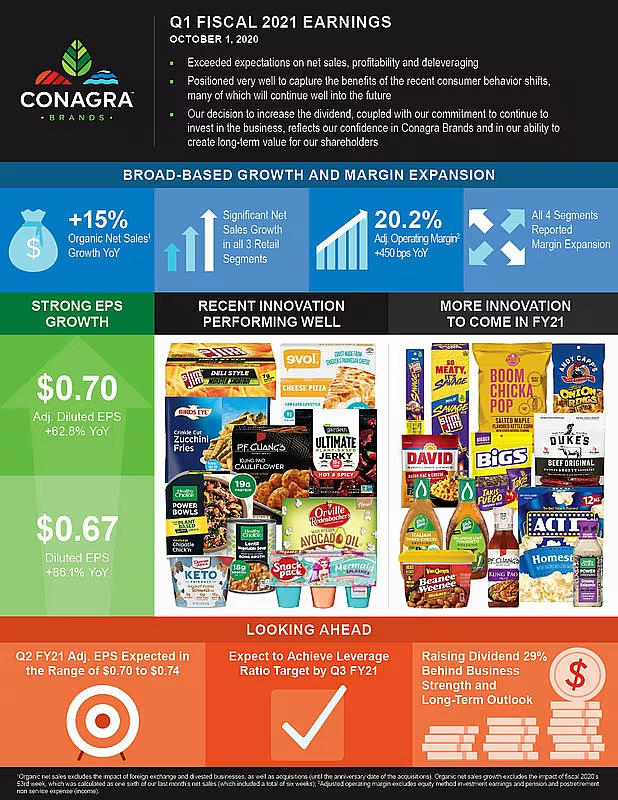

Overall, organic net sales, which exclude impact from mergers & acquisitions and currency fluctuations, rose 15% in the quarter, much higher than the 10%-13% range the company had previously expected.

It expects growth of 6% to 8% in the second quarter.

Adjusted earnings rose to 70 cents per share, 13 cents above analysts' average estimate, according to Refinitiv IBES and the company raised its quarterly cash dividend by 29%.

News by Reuters, edited by ESM. Click subscribe to sign up to ESM: European Supermarket Magazine.