A shift in interest towards health and fitness is driving M&A activity in the sports nutrition market in the EMEA region, with eight notable deals concluded so far in 2024, Oghma Partners has reported.

The global sports nutrition sector is a 'fast-growing market', the corporate finance house noted, growing at a CAGR of 9.0% since 2019. The segment is expected to be worth £33 billion (€38.73 billion) by 2028.

Oghma Partners made its assessment as it examined 100 transactions that occurred between 2014 and 2024 in the sector.

Robust Deal Volume

Despite economic challenges, deal volume in the sector has remained robust. However, larger transactions have been less frequent, with 44.0% of deals in the past three years involving amounts under £10 million (€11.7 million). This trend highlights the prominence of smaller deals, reflecting 'strong strategic interest' in the sector, Oghma Partners noted.

Valuations continue to be elevated, as evidenced by high transaction multiples, with the average enterprise value to EBITDA (EV/EBITDA) ratio at 14.9x and the enterprise value to revenue (EV/Revenue) ratio at 1.9x.

Improving Market Conditions

“Looking forward, we expect relative valuations to remain healthy and a higher volume of larger deals as economic conditions continue to improve," commented Mark Lynch, partner at Oghma Partners. "The prospect of further interest rate cuts will also provide potential buyers, notably private equity, with a favourable opportunity to take advantage of this high-growth market."

European buyers have dominated M&A activity in the sports nutrition sector, accounting for 88.5% of transactions, Lynch added.

"Over the past 10 years, trade buyers accounted for 78.0% whereas as financial comprised of 22.0%," he said. "In terms of targets' location, the UK remains the most prominent region with 35.0% of targets followed by the Netherlands and Sweden.”

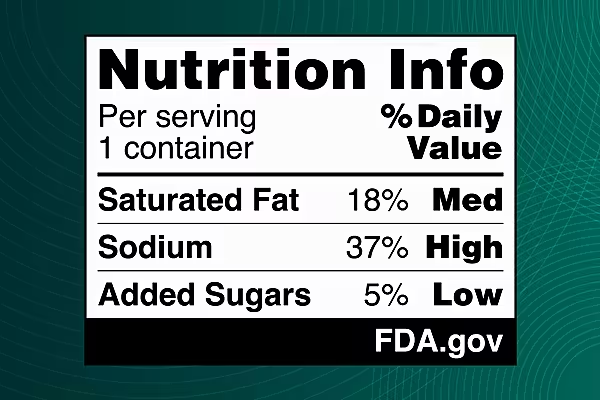

The growth in M&A activity is being driven by a heightened awareness of healthy lifestyles and the impact of government regulations, such as those related to high in fat, sugar, and salt (HFSS) products, Oghma Partners noted.