It may be finding the going a bit tougher in markets such as Denmark, but there’s no doubt that Aldi sees the UK as a core growth opportunity, according to the latest Kantar Worldpanel figures.

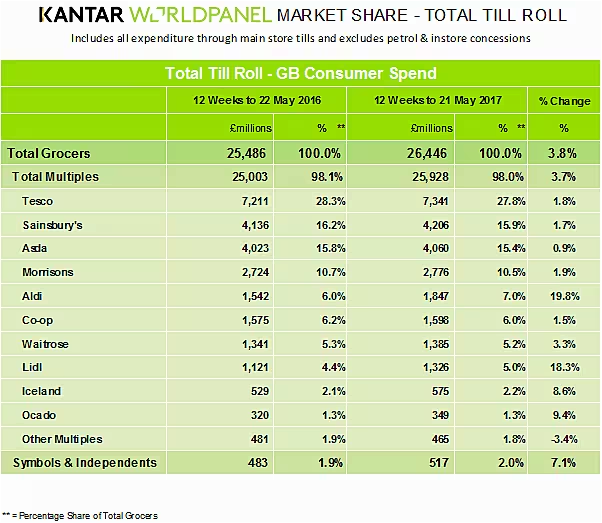

The grocery market-share figures for the 12-week period to 21 May 2017 show that Aldi has posted a sales increase of 19.8% on the same period last year, to now sit on 7.0% market share.

Lidl, too, continues to post impressive growth, rising by 18.3% since last year, to sit on 5.0% market share. According to Kantar Worldpanel, this is the strongest period of growth for both discounters since 2015.

“With sales up 19.2% year on year, the pair achieved a record market share of 12.0%,” said Chris Hayward, consumer specialist at Kantar Worldpanel. “Some 62% of the UK population shopped in an Aldi or Lidl during the past 12 weeks, compared to just 58% this time last year – that’s an additional 1.1 million households visiting either of these stores.”

Big Four

Tesco still leads the retail market in Britain, with 27.8% market share, followed by Sainsbury’s, on 15.9%, Asda, on 15.4%, and Morrisons, on 10.5%. All of the UK’s Big Four retailers have seen an increase in sales since the same period last year, with Morrisons (+1.9%) and Tesco (+1.8%) seeing the biggest gains.

“Tesco has increased sales by 1.8% year on year, attracting over 250,000 additional shoppers during the past 12 weeks,” said Hayward. “Helped by promotions on barbecue foods as the weather gets warmer, sales of fresh meat grew well ahead of the market, at 4.3% versus 0.9% overall.”

Hayward added, “[Asda has] increased shopper numbers by over 360,000 in the past 12 weeks.”

Other impressive performers in the market-share data include Iceland, which saw its sales rise by 8.6% year on year, to sit on 2.2% share, and Ocado, which has grown 9.4% since last year.

“Once again, all ten grocers have seen sales increase, no doubt boosted by higher prices, as inflation continues,” said Hayward.

© 2017 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.