Future Retail Ltd., India’s biggest department store chain that gained from the government’s surprise currency clampdown, still has room to extend the rally that’s more than doubled its market value this year.

The shares of the food-to-fashion retailer are set to rally 22 percent in the next 12 months, according to the average analyst price target compiled by Bloomberg. The stock has surged 128 percent since Jan. 1, beating returns from rivals such as billionaire Kumar Mangalam Birla-controlled Aditya Birla Fashion and Retail Ltd. and Tata group’s Trent Ltd.

A shortage of cash hit purchases of soaps to cars after Prime Minister Narendra Modi in November junked high-value currency bills, driving shoppers to large-format stores like Future Retail that accept credit cards. Sales may jump 25 percent this year as the company adds to its chain of 1,000-plus stores, India’s biggest, Group Chief Executive Officer Kishore Biyani said in an interview.

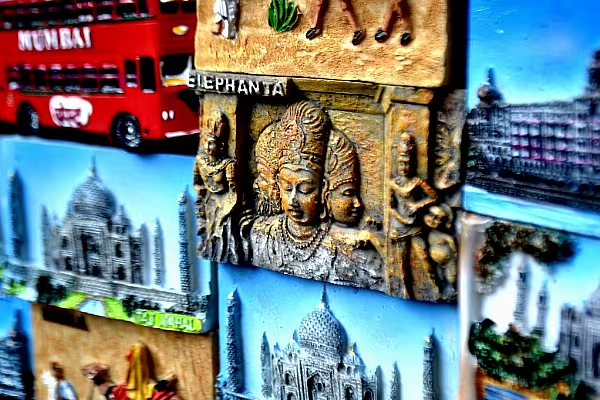

“Demonetization was one big tailwind in recent months and the single goods-and-services tax will be the next big push,” said Himanshu Nayyar, Mumbai-based analyst at Systematix Shares & Stocks Ltd., referring to the sales tax regime that will help retailers buy materials seamlessly from across states after it is rolled out from July 1. His one-year price target of 345 rupees is 18 percent higher than Monday’s close.

Investors are warming up to India’s brick-and-mortar retailers at a time when their online rivals face an intense discount war and eroding valuations. Shares of billionaire Radhakishan Damani-owned Avenue Supermarts Ltd., which sells staples at knockdown rates, have more than doubled from their IPO price in March. The stock hasn’t been added to a popular index yet because of its short trading history. Trent, which sells branded clothes, has advanced 32 percent since Jan. 1. Aditya Birla Fashion has climbed 26 percent.

Credit card spends at Future Retail’s Big Bazaar and Easy Day stores, which stock food and household items, saw non-cash billings surge 86 percent in the November-March period, the company said. The surprise currency recall was announced on the night of Nov. 8.

Turnaround

“Demonetization has in fact helped us clock more revenue,” Biyani said by phone. “We’re also looking to add 2 million square feet this financial year” that began April 1, he said.

Future Retail swung to a profit in the nine months ended December, reporting a net income of 2.45 billion rupees ($38 million) versus a loss of 898 million rupees in the year earlier period. Revenue jumped almost fourfold to 126 billion rupees, according to its website.

The turnaround isn’t just because of Modi’s currency policy change.

In recent years, the company has exited non-core businesses and hived off its supply chain infrastructure to a group firm as part of efforts to lower debt. At the same time, it bought smaller chains, including a dairy products retailer Heritage Foods (India) Ltd., to expand in the convenience stores segment. This area is expected grow 43 percent annually in the next five years, according to Mumbai-based Antique Stock Broking Ltd.

News by Bloomberg, edited by ESM. Click subscribe to sign up to ESM: The European Supermarket Magazine.