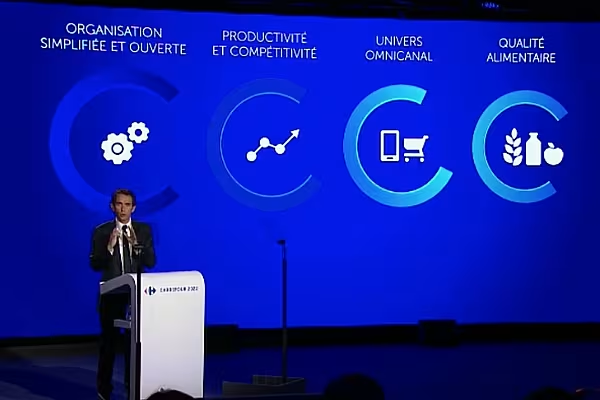

While much of the press attention around Carrefour’s ‘transformation plan’, announced yesterday amid much fanfare, focused on the areas in which the retailer will be seeking to cut costs – voluntary redundancies for 2,400 head-office staff, divestment of 273 ex-DIA stores, etc. – the retailer is not short of ambition when it comes to its digital channels.

Announcing the group’s strategy, chief executive Alexandre Bompard said that Carrefour will invest €2.8 billion over the next five years to “gain a new dimension” in digital and omnichannel. This is around six times greater than the group’s current investment in digital platforms.

As part of this, Carrefour is seeking to double down on its food e-commerce presence, targeting €5 billion worth of sales and a 20% share of the food e-commerce market in France by 2022.

Digital Support

To help it on its way, Carrefour has turned to one of France’s largest advertising and public relations companies – well, its digital arm, at least.

Publicis.Sapient, part of Publicis Groupe, describes itself as ‘the world's most advanced digital transformation platform’, and, with its help, Carrefour will seek to create ‘a unique business platform in every country in which the group operates’.

In France, this will be simply known as Carrefour.fr, with Bompard planning to discontinue other associated e-commerce platforms, such as Ooshop, in the coming months. Carrefour is seeking to develop “a single, general-purpose brand that is identifiable” in each market, Bompard said at the launch of the transformation plan.

On the home-delivery side of things, Carrefour has signed a strategic partnership with delivery firm La Poste, leveraging the latter’s logistics network to roll out its Carrefour Livraison Express service to 15 cities by the end of the year, with Clermont-Ferrand, Dijon, Grenoble, Lille, Nancy, Nantes, Nice, Reims, Rennes and Strasbourg the new additions this year.

A one-hour delivery service also forms part of this expansion, with deliveries set to be handled by Stuart, a subsidiary of the La Poste group specialising in urgent urban deliveries.

Carrefour also plans to use its agreement with La Poste to launch a new delivery service from its Carrefour Drive network, details of which will likely be revealed in the coming year.

Notably, during the launch of the transformation plan, Bompard said that he felt that Carrefour's Drive facility had somewhat “failed”, noting that the group did “not invest enough in the format”. This new venture appears to be an effort to correct that.

Dark Stores

Also notable is Carrefour’s willingness to reappropriate some of its ‘wasted’ hypermarket space as dark stores, to support its burgeoning digital growth plans, which include expanding click-and-collect services to “more than half” of its stores by 2019.

Commenting on Carrefour’s new strategy, Barclays European Food Retail Equity Research said, “While we welcome Carrefour’s more disciplined capex strategy, we consider that the announced €560 million of annual online capex is unlikely to generate very positive returns in the short term. Besides, we question whether the implied [approximate] €1.4 billion annual investment for the remaining ‘bricks-and-mortar’ operations may be too low.”

Analysts were surprised that Carrefour’s transformation plan did not include plans to shelve any of its hypermarkets, despite Bompard himself suggesting that many did not fulfil the needs of their customer base, explaining, “We have to reduce the size of our hypermarkets where they are disproportionate to the catchment area.”

By thinking outside the (big) box and utilising Carrefour’s extensive property assets in a new growth agenda, Bompard and his team may be able to turn the negative of flagging hypermarket sales into positive online expansion.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.