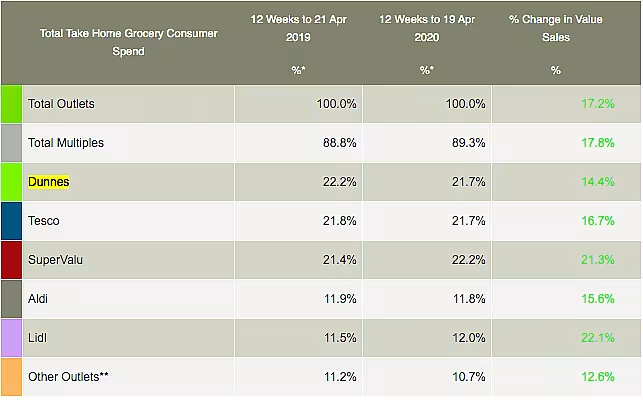

The sales of take-home groceries in Ireland increased by 17.2% in the 12 weeks to 19 April, according to the latest data from Kantar.

The monthly grocery spend increased by €118 on an average with customers adding four extra items to their baskets per visit amid lockdown in the country, the study revealed.

However, the year-on-year growth in grocery sales for the latest four weeks slowed slightly compared with March, to 22.5%.

The average household visited grocery stores 19 times during this period, two times lesser compared to the same period last year.

The study also found that around 10% of Irish households shopped online for groceries and spent an extra €20.6 million.

Households also spent more time cooking from scratch and almost 50% of shoppers bought baking supplies in the recent four weeks.

David Berry, managing director of Kantar Ireland, explained, “In the absence of dinners with friends and lunch on the go, many more meals are being eaten in the home and grocery sales have risen accordingly.

“But social distancing means people are less likely to be buying categories like clothes, food on the go, and general merchandise – which means, for some retailers, the overall picture will be more modest.”

Fastest-Growing Retailer

Lidl emerged as the fastest-growing retailer in the 12 weeks, boosting sales by 22.1% and increasing its market share to 12%, while Aldi grew by 15.6% to hold an 11.8% share.

SuperValu saw sales grow by 21.3%, with a market share of 22.2%, surpassing Tesco and Dunnes at 21.7%.

In the shorter term, SuperValu’s large store estate benefited from shoppers choosing to visit outlets closer to home, making it the only retailer not to experience reduced footfall in the past four weeks, the study noted.

'Change In Shopper Behaviour'

Berry added, “The change in shopper behaviour adds up to an extra €440 million spent on grocery in the past 12 weeks, but this additional spend is impacting individual retailers in different ways.

"Before lockdown, Dunnes customers already spent 80% more than the average shopper each visit at €43.80, which means the retailer has experienced less of a jump in spending per trip than those grocers starting from a lower base. Dunnes is growing slightly behind the rest of the market as a result, but these are extremely narrow margins, and only 0.5 percentage points separate the three retailers at the top of the table."

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: European Supermarket Magazine.