In this month's Buyer's Brief, El Niño is back, and it could have a marked influence on food prices over the coming months, writes Nick Peksa. This article appeared in ESM’s November/December 2023 edition.

The global food market seems to be faced with an ever-increasing array of supply chain issues. The COVID-19 pandemic disrupted supply chains and economies worldwide, but luckily it did not coincide with any major weather shocks that directly affected food production.

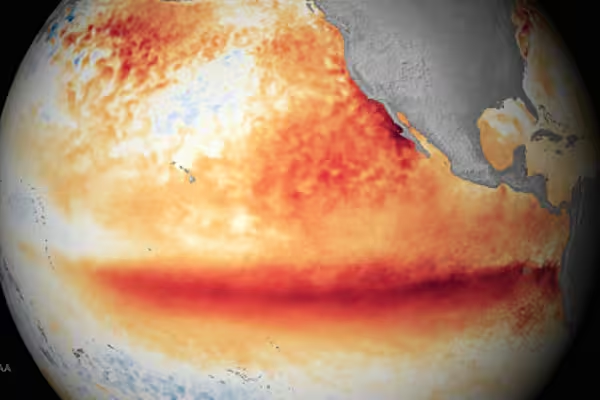

However, the world is now grappling with the convergence of a potentially strong El Niño event, thus creating uncertainty and upward pressure on food prices. The UN’s World Meteorological Organization (WMO) is warning that this could threaten lives and devastate agriculture in some parts of the world.

El Niño events influence at least a quarter of the world’s croplands, particularly those in regions located near the equator.

El Niño Makes A Strong Comeback

After three years of the cooling La Niña weather pattern, El Niño has returned and is anticipated to persist well into the first half of 2024. El Niño is typically associated with alterations in ocean temperatures and atmospheric pressure, setting off a chain reaction of intricate weather phenomena.

El Niño, originating in the Pacific Ocean, is notorious for its capacity to induce extreme weather patterns, such as scorching heatwaves accompanied by heavy rainfall or severe droughts. The impacts of El Niño on agricultural yields can vary significantly based on the region and the crop in question.

A strong occurrence could result in an upward surge in global food prices, with a magnitude of anywhere from 6% to 12%.

Effects on Food Pricing

During a severe episode of El Niño, Southern Africa and Central America often experience reduced maize yields due to drought, South-East Asia encounters difficulties in rice cultivation, and Australia normally witnesses a decline in wheat production.

As it stands, the 2023-24 outlook for Australian wheat is not favourable. Production is forecast to fall by 36%, to 25.4 million tonnes (below the ten-year average). The current El Niño occurrence is particularly disconcerting, given its concurrent timing with Russia’s withdrawal from the Black Sea Grain Initiative in July 2023. On the flip side, global soybean yields tend to see an uptick during El Niño events.

Global rice supplies are particularly vulnerable during El Niño events. As rice is a water-intensive crop, low rainfall in the paddy fields can devastate rice yields. Supply issues have been further exacerbated by major rice-exporting nations, such as India, imposing rice export bans.

Extreme weather also affects the production of other tropical commodities, such as coffee, palm oil, sugar and cocoa in South-East Asia and Africa. A mild El Niño could potentially reduce Malaysia’s palm oil production by 10%, while a severe one might even lower it by as much as 20%. As the world’s dominant vegetable oil, a reduction in palm oil volumes will certainly push the markets up across the entire category.

El Niño-Southern Oscillation’s influence extends to the world of fisheries. As an example, tuna stocks in the tropical Pacific Ocean provide a significant source of food and economic stability for small Pacific Island states, however, catches are reducing as water patterns are changing.

This has potentially severe consequences for these regions, as they rely disproportionately on the tuna industry. Catches from the Western and Central Pacific Ocean account for over half of all tuna produced globally, highlighting the global implications of El Niño on the broader ecosystem.

Beyond the direct effects on food prices and production, financial markets also respond to El Niño developments. Traders in commodity derivatives closely monitor El Niño forecasts, and any disruptions to crop yields can lead to increased price volatility.

Other Global Commodities

El Niño typically reaches its peak between November and February. The consequences on commodity prices may continue to manifest themselves for around 16 months after the initial event.

The ramifications for food inflation, fiscal budgets, monetary policy, GDP and trade – especially in emerging markets – could persist for a more extended period. Moreover, a very strong El Niño could have a broader impact on global inflation, reaching beyond the realms of just food prices.

Closer To Home

The EU is facing a range of problems with food production due to unseasonably warm and varying weather conditions in different regions. For example, the olive oil crisis continues along the Iberian Peninsula.

The northern half of Europe experienced favourable conditions for crop growth and harvesting during the first half of autumn, although South-Eastern Europe did not fare as well. In parts of Bulgaria, Hungary, Romania and Greece, high temperatures and low rainfall have led to reduced-yield forecasts for grain, corn and sunflowers.

Additionally, areas including Slovenia, Croatia and parts of Ukraine have been affected by dry soil conditions, impacting the sowing and emergence of winter crops, particularly rapeseed.

Ending Thoughts

I know that I have used the phrase ‘a perfect storm’ before, however, the supply chains of the world are currently very delicate. For emerging markets, where food typically constitutes a large portion of consumer spending, the combined effects of these continual supply shocks could result in increased levels of food inflation. This, in turn, may prompt banks to keep interest rates higher for longer, impacting equity and bond markets.

Whilst this is damaging to the economy of a nation, what is even more concerning is, when food prices spiral out of control, it can result in mass food poverty and civil disorder. Think back to the Arab Spring in 2010 and the food riots in sub-Saharan Africa in 2007-08 – weren’t these also El Niño years?

Developed markets will not escape unscathed from the impacts of El Niño, with increases in the prices of cocoa, rice, sugar, and potentially vegetable oils to spiral out of control. We have seen the problems caused by drought on olive oil from the Iberian Peninsula – this could just be the start.

Could fruit prices spike from South America? Could we see large volumes of EU crops damaged by flood waters? Could Europe experience another energy crisis? Only time will tell.

For more information, contact nick.peksa@cost-insights.co.uk.

Main picture: Satellite sea surface temperature departure in the Pacific Ocean for the month of October 2015, where darker orange-red colours are above normal temperatures and are indicative of El Niño. (Image credit: NOAA)