According to leading research firm Nielsen, the answer is yes. Here's how.

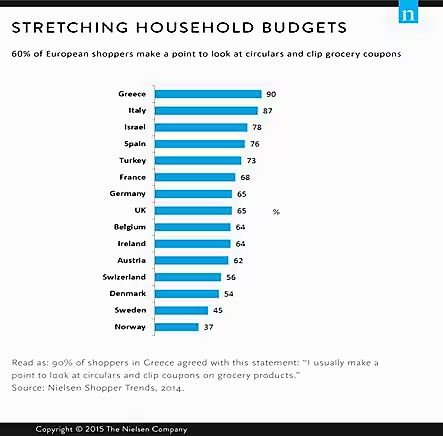

Does the lowest price always win? In Europe's sluggish economy, it can certainly seem that way. Shoppers are hyper-price-aware – 40 per cent claim to know the prices of most products they buy and notice when price changes. They're also actively seeking lower prices. In fact, 60 per cent of European shoppers make a point of looking at leaflets and collecting coupons for grocery products.

As a result, discount retailers have gained significant traction throughout the region, and conventional retailers are aggressively cutting prices to stay competitive, but continual discounting is not sustainable. Not only are these practices lowering margins and profits, but they’re also potentially damaging the sector's appeal to investors.

While European consumer confidence remains low, it's slowly rising. And with this rise, some shoppers are now considering aspects other than price when choosing stores to visit and goods to purchase.

In fact, a recent Western European study from Nielsen’s Shopper Trends survey, which measures retail equity and loyalty across more than 50 markets, found that the factors highest on consumers' shopping lists were not cost-related. Europeans rank convenience, shopping experience and quality products as their top considerations when shopping, and some retailers are already helping shoppers find what they're really looking for using technology to exploring new store formats.

Time Is Money

European shoppers rank 'easy to quickly find what I need' as the number-one influence in their choice of store. In fact, consumers value it almost two times more than having a wider variety of products. With the average supermarket carrying anything from 15,000 to 60,000 SKUs (depending on store size), it’s easy for shoppers to waste time trying to find items or a member of staff to point them in the right direction.

With mobiles now in many shoppers' pockets, some retailers are leveraging apps to speed up shopping. One retailer is rolling out an app that allows customers to build a virtual basket of favourite products before they even get to the store. Once they are in store, the app then helps them navigate the store to find items faster. Shoppers can also scan items at the shelf with the app and then pay through their smartphone, reducing checkout times to mere seconds.

Beyond technology, some retailers are reimagining stores themselves. Some are pursuing growth through smaller, convenience or neighbourhood formats, with carefully selected product ranges geared specifically to local needs and tastes. For others, smart store layouts are helping shoppers get in and out quickly with all the items they need. One retailer focuses on shopper missions, placing 'food for now' and 'food for later' products at the front of the store, with items considered store-cupboard essentials at the back.

Worth The Trip

Shoppers place a high value on the shopping trip itself – as long as they get something out of it. Ranking in second position was 'providing an enjoyable experience'. Comparatively, 'convenient to get to' comes in at number 11, indicating that shoppers are willing to travel for the right store. That means out-of-town hypermarkets that are not perfectly convenient can still retain shopper loyalty – with quality services.

Stores are rapidly becoming more than just a place to shop, and their offerings should reflect changing shopping habits. Some retailers are improving shoppers' experiences with luxury features such as: concierge-like click-and-collect pickup counters; complementary tech in stores; and hospitality areas such as wine bars, cafes and restaurants, recognising that shopping is a social activity and stores are becoming a place to spend time. The in-store experience can help retailers differentiate and fight for market share.

More For Our Money

Quality products are also a must to win shopper loyalty. Ranking third on consumers’ list of the biggest influences on their store choice was 'food and groceries that are value for money'. While 'good deals and promotions' are important, ranking ninth, shoppers don't see them as a key differentiator across stores, and one of the most effective ways retailers can avoid price cuts and promotional strategies that are not sustainable is to increase the perceived benefits and value of their private-label options.

Private label is more developed in Europe than anywhere else in the world, particularly in Western Europe. In fact, European private label accounts for $1 in every $3 spent in the region's consumer packaged goods (CPG) market. Private label has come a long way since the generic 'me-too' product. Across Europe, 40 per cent of private-label shoppers report private label as really good value for money.

Retailers can do more to grow market share by innovating and introducing private-label products for shopper segments that aren't driven by deals. Recent private-label innovations include: fresh local/regional produce that is able to command a premium; 'better for you' product ranges that carry easily identifiable colour-coding (which work with calorie-counting apps); and private-label brands that are both premium and exclusive. Exclusivity, when done well, has the power to pull in traffic, make it more difficult to price compare, and help drive repeat visits.

Bring Shoppers In, Make Them Stay

For European consumers, the best deal is not always simply getting the lowest price. By focusing on the shopping experience – from convenience to the quality of the trip – and by offering quality private-label goods, retailers can compete with discounters and drive Europe’s retail landscape forward.

About The Nielsen Shopper Trends Survey

Nielsen Shopper Trends is an annual study that focuses on modern trade and outlines the key drivers of customer loyalty, resulting in retailer equity within countries and across regions. The Nielsen Shopper Trends survey is conducted annually between October and March, and polls more than 90,000 shoppers in more than 50 markets. For the purpose of this article, the identification of the top three Western European store-choice drivers was based on a regression analysis of the attributes driving store equity from 17 Western European markets on 2013-2014 data.