The effects of the COVID-19 pandemic will be felt for many years to come, particularly in FMCG, where retailers and manufacturers have had to adapt, and in some cases transform, the way they meet the changing demands of shoppers. Patrick van der Zee, Senior Vice President International Retail, IRI, looks at how and where we shop today and how retailers need to adapt to these shifts in consumer behaviour.

From the enforced restrictions of lockdown over many weeks, to new ways of shopping as lockdowns ease (or in some cases, return) we have seen striking changes in consumer behaviour as a result of COVID-19.

Even as restrictions are relaxed and there is a desire to ‘return to normal’, many of these behaviours will stay with us, while others will continue to evolve. But it’s unlikely that we will see a return to the exact way we have done things before.

The most interesting changes in shopping patterns are a shift in favour of online and proximity channels. Online grocery shopping penetration across Europe pre-COVID was low, but new behaviours have seen demand for online shopping grow exponentially compared to previous years as people try to limit the amount of time they spend out of the house.

E-commerce, it seems, is no longer just about convenience and saving time; it has the added element of health and safety in these unusual times.

A Steady Shift Online

As share shifted more to e-commerce in the early stages of the crisis, it has remained at a steady, elevated level.

In Italy, for example, e-commerce spending was low compared to other markets at just 1% share, but is predicted to reach 4% by the end of 2021, maintaining 95% growth year on year. In the UK, despite four consecutive years of slowing growth, the online grocery market share increased from 6% to 10% during lockdown, and is forecasted to grow 33% in 2020, worth an estimated £16.8 billion.

The impact of the pandemic is also bringing new audiences online. Older shoppers, who previously would have visited a store, have changed their habits if they are self-isolating or concerned about going out. According to an IRI Germany Shopper Survey, 7% of baby boomers ordered food online during the crisis and 5% intend to continue.

While older shoppers are still in the minority, supermarkets need think about how they make the online process easy for them.

Retailers also need to expand their online delivery capacity and invest in services if they are to meet demand. This includes click and collect services, which are simpler and more cost-effective than developing the infrastructure for home delivery.

One option is to invest in the business, like Tesco, which added 200 vans to its fleet and hired thousands of new drivers to help grow its home delivery business. Another is to partner with others, like M&S, which teamed up with food delivery company, Deliveroo, so consumers can order essential items for same-day delivery.

Proximity – The End Of The ‘Convenience Stores’ Euphoria?

Location has always been a key factor in store choice for shoppers, but during the pandemic, and particularly in the lockdown phase, it has become even more so.

At the start of the crisis, people had no option other than to shop locally, due to restrictions as to where they could travel or simply through fear of entering a larger, busier store. Being able to shop for essential supplies close to home has been important, perhaps even a lifeline for some, and the convenience channel and smaller stores have seen a huge increase in footfall as a result.

But as restrictions lift and people feel more comfortable about travelling further afield, the question is whether convenience will suffer at the expense of the big retailers and discounters?

For some shoppers, like in the UK, there is a level of returning to more familiar shopping habits, such as a regular shop at a big store. For others, convenience and proximity are still important, however high prices in these stores will impact demand. As such, we are seeing growth in discounters that are responding to demand for lower prices and proximity.

For those consumers who now see the benefits of shopping locally and the range of products in-store, convenience will play a much broader role than just as top-up shops, particularly in meeting demand for the new ‘eating at home’ trend, which has replaced eating out. Categories, such as ready meals or ready to cook are now much more accessible to shoppers, less expensive than restaurants and closer to home.

The Discounter Bounce-Back

Despite the fact that the discounters are falling behind supermarkets in their e-commerce offerings, they do offer shoppers the benefits of both proximity and low prices.

With a predicted 8.3% drop in GDP this year for the 27 economies of the EU, the economic downturn could very well prove to be a driver behind the discounter bounce-back. According to an IRI Italy Shopper Survey, nearly a third (32%) of Italian consumers plan to visit this format more frequently.

Already well established and starting to position themselves as supermarkets with a limited range, discounters will continue to grow, leveraging the need for consumers to trade down. Supermarkets will need to differentiate themselves and provide a range of products and prices adapted to various profiles of shoppers that have a big discrepancy of budget available.

We have seen Tesco launch a new price strategy against the discounters in the face of a COVID-driven recession, in an effort to prevent a second growth phase after the success of the discounters in the wake of the 2008/9 banking crash. First with its price-matching campaign against Aldi pre-lockdown, and now with its Great Prices Every Day – with plans for everyday low pricing for own label and brands – Tesco has set out its stall, quite literally.

The Death Of Foodservice?

With restaurants, cafes, bars and many other food outlets closed during lockdown – and many still unable to open or with reduced capacity due to social distancing measures – the foodservice sector has been hit the hardest. IRI estimates suggest food service may lose up to 20% of capacity post-lockdown.

The fact is that although some restaurants and cafes are opening up, this sector faces a very uncertain future. While consumers have been rolling up their sleeves to bake their way out of lockdown and re-create favourite take-aways, sales to date have shown that the grocery sector will not replace the lost value from the out-of-home (OOH) channel, driven in part by the large differential in price.

Suppliers with a high proportion of sales in the OOH channel will need to establish alternative routes to market to recoup losses. Similarly, foodservice and licensed operators and wholesalers are already seeking out innovative solutions to this challenge, such as direct-to-consumer or take-home services.

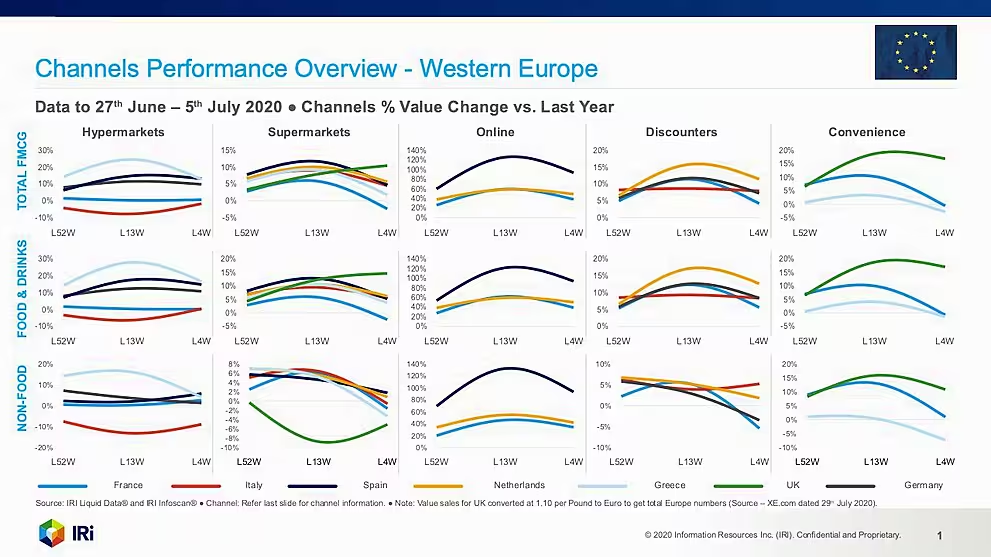

[click image below to open full size]

Conclusions

COVID-19 has changed the way people live and how they shop. Many of these behaviours are still evolving, while others are here to stay. Where we shop, when we shop and how we shop is more important than ever.

The ‘next best thing’ has replaced finding the products we love, with convenience and speed taking priority over brand preference. Getting that all-important online delivery slot is worthy of bragging rights, while eating-in has become the new eating-out as the industry taps into the growing at-home meal preparation market.

There is still the question of what happens next. There is the possibility of a resurgence of the virus. We have already seen spikes in some countries and regions, leading to new restrictions, or delays in lifting earlier restrictions.

In the ‘next normal’ it could be that as an industry we have to be ready to move ‘back in time’ sometimes as restrictions are imposed once again.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Patrick van der Zee, IRI. Click subscribe to sign up to ESM: The European Supermarket Magazine