Amazon has announced a new '30 minute pickup' service in selected Whole Foods stores in the US.

A selection of Whole Foods Market’s fresh and organic produce, bakery, dairy, meat and seafood, floral will be available to order and pickup 30 minutes after ordering by the customer.

This is further evidence of Amazon’s willingness to continue the integration between Whole Foods and the Internet giant's core business.

The pickup service isn't an entirely new innovation in the US, as competitor Walmart already has such a platform. However, the two retailers are catering to very different demographics.

Did Amazon Take A Page From French Retailers?

As a French consumer, my first reaction was thinking that Amazon has borrowed a line from French retailers and brought the 'Drive' system to Whole Foods.

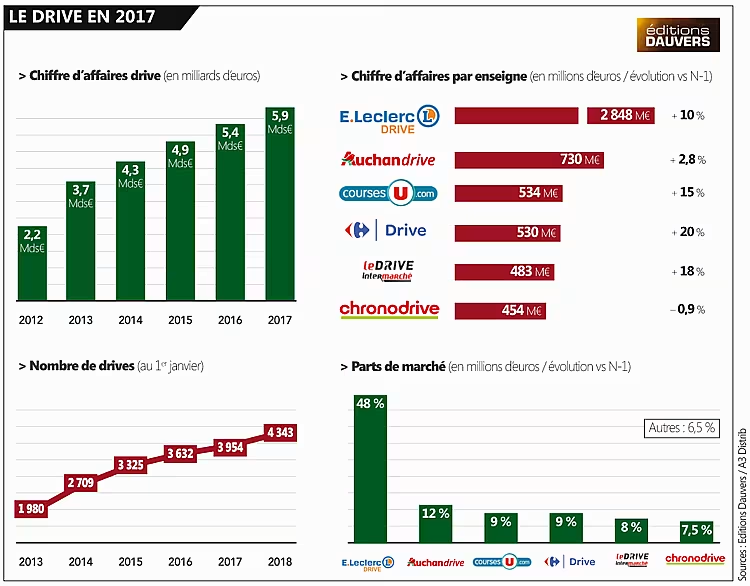

The format has been gaining pace in France over the last few years, with several of the country's biggest retail players seeing double digit sales growth through the channel in 2017, according to French retail consultancy Olivier Dauvers.

For instance, Drive is an integral part of Carrefour 2022 transformation plan, with chief executive Alexandre Bompard acknowledging the format as offering "unique capacity to serve our customers, especially in large cities."

To that end, he added that the group was "building an automated system for the preparation of orders, [which] will enable us to improve our productivity and the quality of services."

The Drive Format In France : Success, But Little Profit

He may have to, because in France, the Drive format, as it exists, is free, and therefore often operates at a loss for retailers.

As Valentine Bauret of Agro-Developpement, a club of French food manufacturers, explains, “Retailers usually complain about the last mile delivery. In France, with Drive, you don't have that, but since there is no charge for using the service, you still have to open your warehouse, you still need to have staff there, so you still have some costs to carry."

Because of that business model, she adds, that the addition of Drive might be a “way of buying market share” in large cities, where one retailer could “have a big supermarket south of a big city, then you open a Drive in the north of that big city, as a way of buying market share".

Could Amazon Re-Invent Drive?

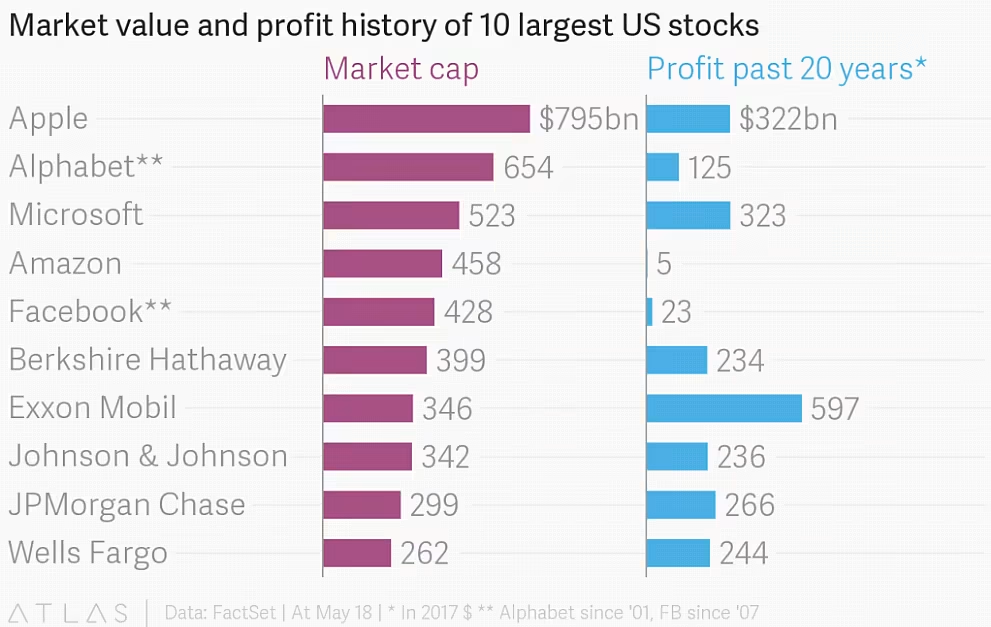

Historically, Amazon has made little in the way of profits. Indeed, since the late 90s, Jeff Bezos’s company has famously decided to reinvest everything in its operations in serving its long-term growth goals rather than sit on its profit pile.

According to business website Quartz, Amazon made $5 billion in profits over the last 20 years, whereas other Internet giants such as Apple or Alphabet (the parent holding company of Google) each made hundreds of billions. Facebook, which only began to make a profit in 2009, also outranks Amazon in terms of profit generation.

This is because for years, Amazon has invested everything it makes in its supply chain operations, building warehouses and improving the efficiency and reach of its organisation. It would therefore not be a shock to see Amazon invest in its Drive platform quite considerably as well.

Carrefour has certainly not stood still on the tech front, and recently teamed up with Google in France in order to secure its position. Auchan has also recently been in the process of revamping its Drive operations, as noted by according to French retail consultancy Olivier Dauvers.

But what happens next will be interesting.Amazon would certainly have the capital to invest in buying a retail chain in France, as it did in the US when it invested $13.7 billion cash, in Whole Foods.

If it were to do so, and bring its version of Drive to Europe, the bar will undoubtedly be raised.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Matthieu Chassain. Click subscribe to sign up to ESM: European Supermarket Magazine.