Recent trends in the self-checkout system market are being powered by an increase in the adoption of AI and the development of technologically advanced solutions. In the era of automation, the systems are being considered as a key solution to the rising labour shortage.

For example, in July 2021, Kyocera’s Advanced Technology Research Institute developed an AI-based system for the instant recognition of products, enhancing the efficiency of checkout, and the reduction of physical contact.

As claimed by the company, the solution was designed for the identification of an array of overlapping solutions and is expected to be more affordable and accessible for small enterprises.

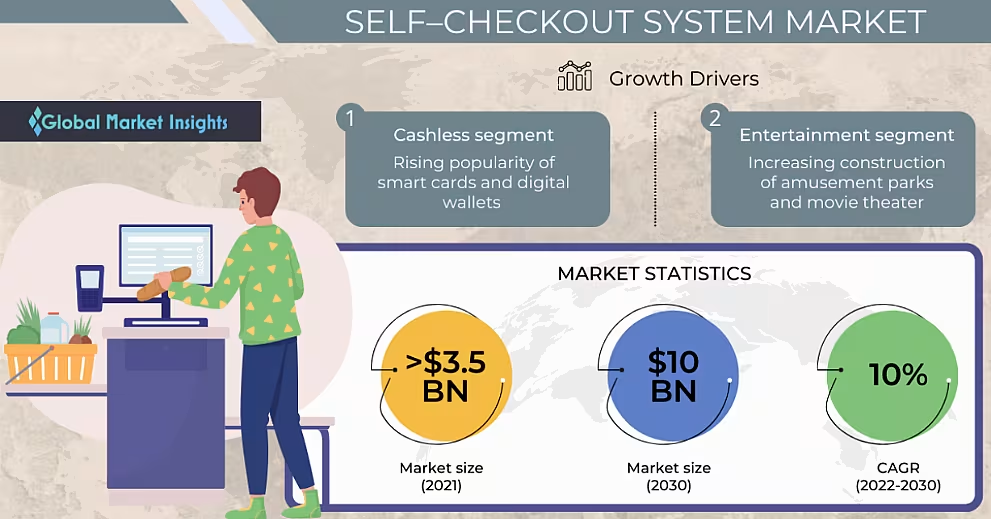

An increase in such advancements is anticipated to impel business growth over the ensuing years. As per the latest report published by Global Market Insights Inc, self-checkout system market size is poised to cross $6.5 billion (€6.43 billion) by 2027.

Some of the key trends that are slated to impel the industry growth are as follows:

Increased Product Adoption In North America

Several retail stores in North American are installing self-checkout systems with an aim of enhancing consumer experience. As an example, in June 2021, Calimax announced plans for the introduction of self-checkout systems in the Mexican states of Sonora and Baja California.

Under the initiative, the company planned to expand its deployment of self-checkout systems to eight additional stores. An increase in similar initiatives is anticipated to propel regional expansion over the ensuing years.

Rising Number Of Collaborations

Prominent players in the global self-checkout systems market comprise Olea Kiosks, Inc., IER, Inc., ECR Software Corporation, Toshiba Global Commerce Solutions, Diebold Nixdorf, Inc., Fujitsu Limited, Gilbarco Inc., Digimarc Corporation, Pan-Oston Co., ShelfX, Inc., IBM Corporation, and others.

These companies are eager to invest in mergers, acquisitions, collaborations, and partnership agreements as they seek to strengthen their industry foothold.

Read More: Tesco Unveils Plan To Reduce Staffed Tills, Many Shoppers Unhappy

For example in September 2021, Conad Nord Ovest expanded its partnership with Diebold Nixdorf and Distribution Service for the deployment of self-checkout solutions in its stores. The deal would comprise the installation of 90 units in Conad supermarkets and hypermarkets in Liguria, Piedmont, Sardinia, Tuscany, Valle d’Aosta, Lazio, and Emilia.

Growing Product Deployment On Account Of Space Optimisation

Several retailers are considering the installation of self-checkout systems due to the better use of space and a reduction in the number of deployed sales personnel. For instance, five or six self-checkout kiosks can be accommodated in the space required for one traditional cashier system.

Furthermore, a single employee can be appointed for supervising half a dozen kiosks, which helps in optimising personnel deployment, leading to a reduction in labour costs. Similar aspects are anticipated to augment overall product demand over the forthcoming years.

To sum up, the escalating demand for digital payments globally is expected to drive the adoption of self-checkout systems over the coming years. Self-checkout solutions allow for seamless transactions leading to faster checkouts processes, factors that are expected to bolster the self-checkout system market share over the estimated period.

© 2022 European Supermarket Magazine – your source for the latest Technology news. Article by Shreya Bhute, Global Market Insights. Click subscribe to sign up to ESM: European Supermarket Magazine.