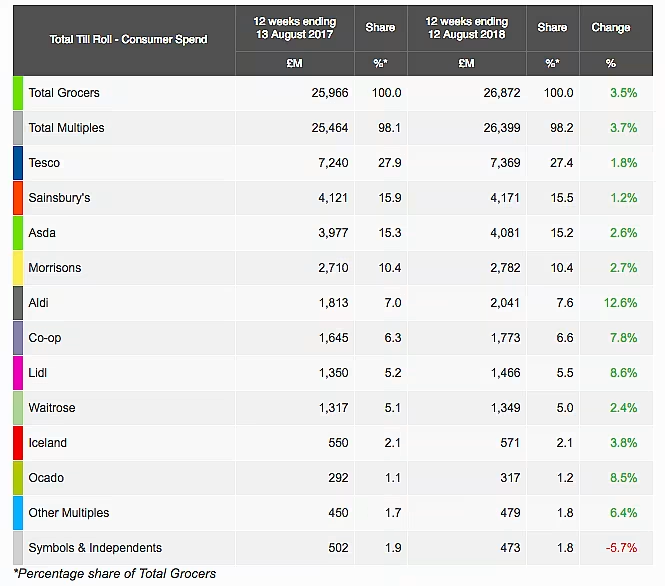

The latest market share figures from Kantar Worldpanel, for the 12 week period to 13 August, indicate that Morrisons (+2.7%, to sit on 10.4% market share) and Asda (+2.6%, to 15.2% market share) were the fastest-growing of the ‘Big Four’ retailers in the most recent period.

“With growth up 2.7%, Morrisons regained its position as the fastest-growing of the big four supermarkets,” commented Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel.

“Over the past 12 weeks Morrisons cut back on promotions and also gained 231,000 new shoppers, 66% of which were more affluent ABC1 customers.”

Tesco posted 1.8% sales growth in the period, and leads the market with 27.4% market share, while Sainsbury’s grew 1.2% to sit on 15.5% market share, just 30 basis points ahead of Asda, with which it is involved in a takeover process.

Fast Movers

The fastest-growing retailer overall was Aldi, which posted 12.6% growth in the period, to sit on 7.6% share and fifth overall, a comfortable percentage point ahead of sixth placed Co-op (6.6%) and two percentage points ahead of rival Lidl (5.5%).

“Aldi witnessed double-digit growth of 12.6%, helping the retailer up its share of the market to 7.6% – a 0.6 percentage point increase on this time last year,” said McKevitt.

“Over half of the retailer’s growth came from the fresh and chilled aisles, with meat, dairy and ready meals performing particularly well.”

Both Co-op, which saw a 7.8% rise in sales in the period, and Lidl, which saw sales rise 8.6%, were among the strongest performers.

As McKevitt explained, Co-op experienced its fastest rate of growth in nearly seven years in the period.

“The last time Co-op saw sales growth of 7.8% it was still benefiting from the acquisition of Somerfield, so its performance is particularly notable this period,” he said.

“Consumers’ current preference to shop locally when the sun is shining has helped Co-op attract an additional 263,000 new shoppers through its doors. The retailer also saw the average customer visit 22 times over the 12-week period, contributing to a market share increase of 0.3 percentage points to 6.6%.”

Branded Fightback

The period was also noticeable for the fact that branded product growth of 3.9% was more pronounced than own-label (3.5%).

“Consumers’ willingness to spend that little bit extra to fully enjoy the summer sunshine has helped push brands ahead of their own-label counterparts,” said McKevitt.

“At Tesco and Sainsbury’s branded growth has outstripped own-label for a while and – as the two biggest retailers in the grocery market – this has contributed to the market shift. More expensive premium own-label lines across the market are still growing strongly though – up 6.3%.”

Grocery inflation stood at 1.9% for the 12 week period, with prices rising consecutively since the 12 week period of 1 January 2017. Prices are rising fastest in markets such as cola, butter and canned fish, Kantar Worldpanel said.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.