ARD Finance S.A. has announced plans to raise $2.22 billion (€1.99 billion) equivalent of debt financing through an offering of Senior Secured Toggle Notes due 2027.

Proceeds from this offering will be used, among others, to fund the redemption of the Senior Secured 8.750% PIK Notes, due 2023, issued by ARD Securities Finance SARL at an accreted amount of $399 million (€359.21 million).

ARD Finance owns approximately 92% of the packaging firm, Ardagh Group S.A.

Debt Maturities Extended

Leverage of Ardagh Group S.A. will be unaffected by this intended financing, with its parent company debt maturities extended from 2023 to 2027, the company said

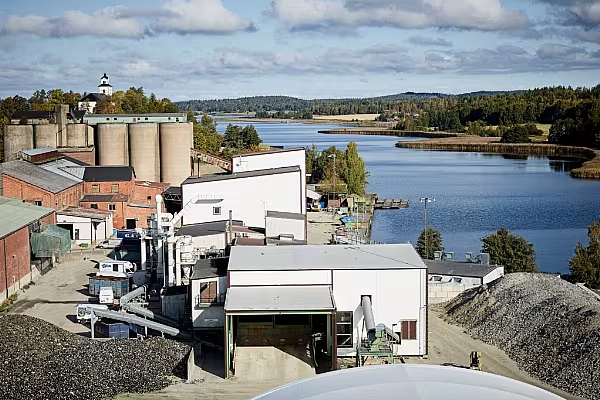

Ardagh Group is a global supplier of recyclable metal and glass packaging for leading brands across the globe.

It operates more than 50 metal and glass production facilities in 12 countries across three continents, employing over 16,000 people, with sales of $7 billion (€6.3 billion).

In the twelve months ended 30 September 2019, pro forma for the disposition of its food and speciality business, Ardagh Group S.A. recorded revenue and adjusted EBITDA of $6.67 billion (€6 billion) and $1.18 billion (€1.06 billion) respectively.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: The European Supermarket Magazine.