Moody's Investors Service has noted that the outlook for the global paper and forest products industry remains 'stable', with operating earnings among the major players set to 'grow modestly' over the next 12 to 18 months. However, it said that escalating costs in the sector are likely to 'dampen the benefit of higher prices'.

In its report, Paper, Packaging & Forest Products – Global: Outlook remains stable as escalating costs offset higher prices, Moody's said that the paper packaging and tissue, timber and wood products, and market pulp segments all continue to carry 'stable' outlooks, while the outlook for the paper segment remains negative.

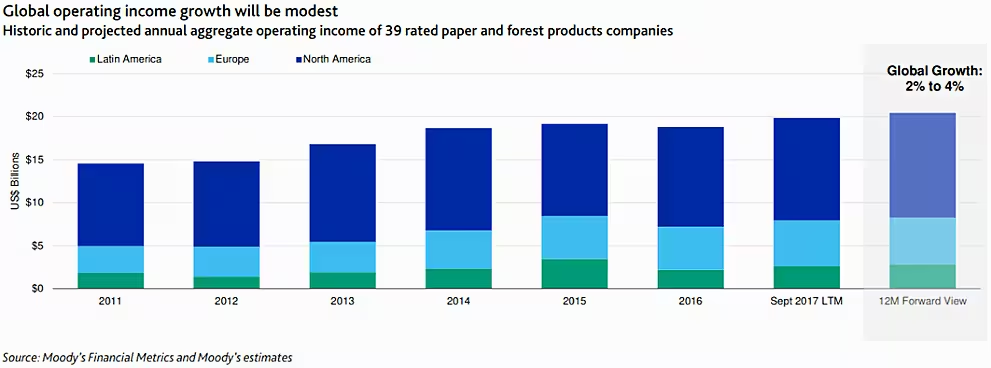

"We expect the consolidated operating income of the 39 paper and forest products companies we rate globally to grow 2% to 4% in the next year or so," commented Ed Sustar, Moody's senior vice-president.

"Higher prices, productivity improvements and acquisition-related synergies, as well as stronger demand for wood product, paper packaging and market pulp, will drive profit growth, but will be partially offset by lower demand for paper and rising freight, labour, energy and chemical costs," Sustar added.

Earlier this month, Moody's said that price increases within the paper sector are only likely to provide temporary relief to the sector.

Income Growth

In the paper packaging and tissue subsector, Moody's noted that the companies that it rates are likely to post 'modestly stronger operating earnings', with growth of around 3%, boosted by the e-commerce and agriculture packaging segments.

The timber and wood subsector, meanwhile, is expected to see 4% operating income growth, driven by an expansion in the US housing market, which is expected to lead to increased demand for lumber, plywood and oriented strandboard. Prices will mostly remain close to 2017 levels, it said.

The market pulp segment is likely to see operating income rise by 3%, as demand increases and average prices across most pulp grades remain flat, Moody's said. However, it noted that the strong prices seen at the start of the year will likely reverse during H2, as supply begins to outstrip demand.

Paper Decline

Within the paper subsector, Moody's negative outlook is as a result of decreasing demand, with consumption of most paper grades expected to decline by around 5%, as consumers switch to digital alternatives to paper.

'However, in most regions this shift will be more than counterbalanced by higher prices, as paper producers keep pace with falling demand by idling or converting paper-making machines,' Moody's noted, with Latin American producers, in particular, seeing operating earnings rise as a result of improving economic growth and a stronger performance by larger rated producers.

European Outlook

Within Europe, Moody's said that it expects the consolidated operating income of the 11 European producers that it rates to increase 2%-4% over the outlook period. These companies represent about 27% of the global rated industry’s operating income.

Moody's noted that it expects 'stronger prices and demand across most subsectors, including specialty paper and paper packaging', however, paper producers are likely to be impacted by declines in demand, which could be partially offset by stronger pricing this year.

'Paper packaging companies, such as Smurfit Kappa Group plc (Ba1 stable), Metsa Board Corporation (Ba1 stable) and Mondi plc (Baa1 stable), will benefit from ongoing productivity improvements and slightly stronger demand and prices,' it noted.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Kevin Duggan. Click subscribe to sign up to ESM: The European Supermarket Magazine.