SIG Combibloc is on track to announce in September its intention to float on the stock market in Zurich, two sources familiar with the matter said, in a listing that could value the Swiss packaging maker at about €4.5 billion.

Goldman Sachs, Credit Suisse and Bank of America are global coordinators for the listing. The sources said Morgan Stanley, Citi and Barclays are bookrunners on the deal.

SIG Combibloc's private equity owner Onex did not respond to a request for comment. Morgan Stanley, Citi and Barclays declined to comment.

Finance industry sources said they expected a flurry of new listings in September in Europe, where proceeds from initial public offerings (IPO) of European firms rose 35% in the first half of the year to almost $30 billion, according to Thomson Reuters data.

Plans Parked

But a while more IPOs are expected a high proportion of listings being shelved has put bankers on edge.

For example, two HNA-backed Swiss companies - ground services and cargo handling unit Swissport Group and airline caterer Gategroup - have cancelled flotation plans. More recently the London IPO of education company GEMS was shelved.

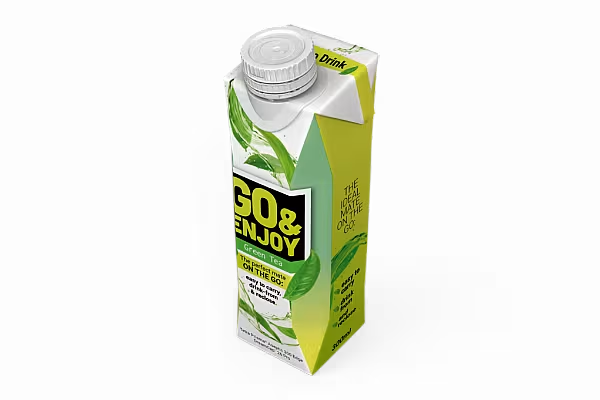

SIG makes cartons for beverages and food and competes with larger rival Tetra Pak, part of Tetra Laval. It is expected to post earnings before interest, tax, depreciation and amortisation of about €450 million this year.

The company was previously listed in Switzerland as part of the Schweizerische Industrie Gesellschaft (SIG) conglomerate that made everything from juice cartons and passenger trains and military weapons. Its businesses were gradually sold off as the company trimmed its focus to packaging.

SIG currently employs than 5,000 people at about 40 locations around the world.

News by Reuters, edited by ESM. Click subscribe to sign up to ESM: European Supermarket Magazine.