European paper and packaging firms are likely to turn their attention to new investment prospects in the coming years, following a prolonged period of deleveraging, Moody's Investors Service has said via a new report.

The report, After deleveraging, companies are likely to focus on new investment prospects, claims that most European pulp, paper and paper-packaging companies with Ba and Baa ratings have 'built up financial flexibility' that will enable them to 'step up' capital investment in additional projects, without impacting their credit quality.

These include Smurfit Kappa Group plc, ENCE Energia y Celulosa, SA, Mondi Plc, Metsä Board Corporation, UPMKymmene and Progroup AG.

'We think that M&A activity will continue to be a less attractive proposition because valuations are currently high and most market segments are already quite concentrated,' Moody's wrote in the report.

Profit Focus

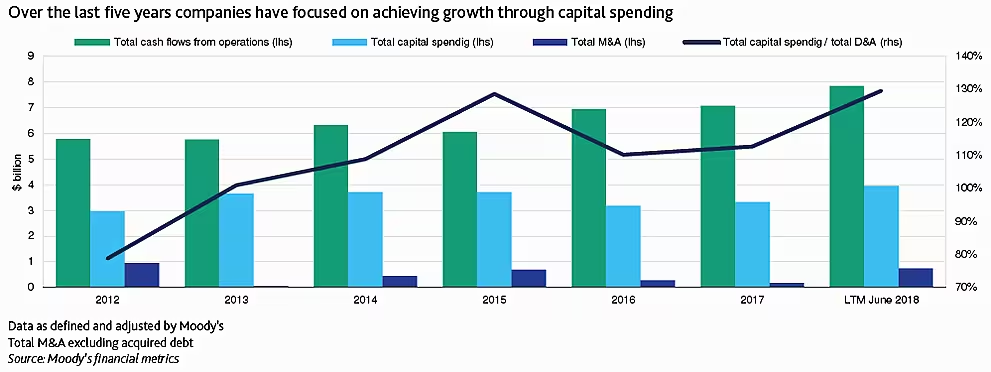

Across the sector, EBITDA has been boosted by strong underlying demand growth, restructuring efforts, and focusing on more profitable niches.

In addition, M&A activity has been 'fairly limited', with many companies using free cash flow to repay debt levels.

"European paper and packaging companies are likely to step up investment after successfully reducing leverage over the past few years," said Martin Fujerik, vice-president – senior analyst at Moody’s.

"Indeed, most firms are now operating below their self-imposed net leverage targets. As a result, any spending on new and existing projects that sticks within their current financial policies is unlikely to hit credit quality," added Fujerik.

Balance Sheet Strength

Moody's noted that the further strengthening of balance sheets among pulp, paper and paper-packaging companies is unlikely, with the capital structures of many companies currently robust.

'We do not think that the industry's debt load will decline further,' it wrote. 'Most of the Ba and Baa-rated companies have capacity to materially leverage up their balance sheets again because they are currently operating below or well below the self-imposed leverage targets/ceilings that some of them recently introduced or tightened.

'Most of the companies also have sufficient capacity to increase investments significantly at their current ratings.'

While a number of firms operating in the sector are planning to speed up their investments, the group said, most of these investments will be largely covered by operating cash flows.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.