The paper packaging market is likely to remain under pressure in the medium term, as the first half results of some of Europe's largest producers has revealed a mixed picture, according to Moody's Investors Service.

Paper and pulp producer Sappi, along with packaging producers Mondi and Stora Enso, reported revenue declines of between 3% and 6%, Moody's said, with Sappi recording the largest drop in revenue due to it cutting volumes to safeguard pricing.

However, UPM-Kymmene and The Navigator Company, two other producers of graphic paper, saw their revenues increase by 2.8% and 4.6% respectively.

Higher Selling Prices

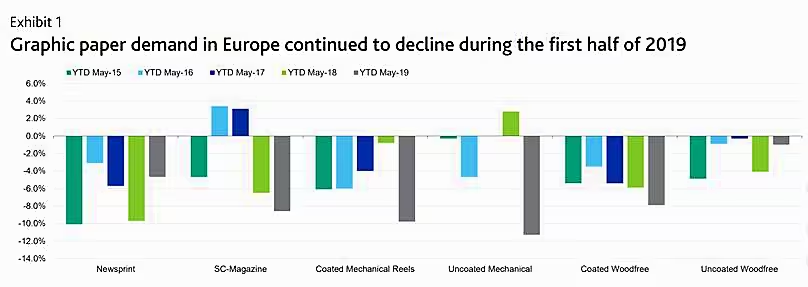

'Despite the continued decline in demand for paper during this period, most rated graphic paper companies managed to keep EBITDA broadly flat because of higher selling prices for most paper grades,' Moody's said.

'This is credit positive for the sector and follows substantial production capacity closures and conversions across all the graphic paper grades over the past decade.'

Moody's added that it also expects prices for coated woodfree paper (CWF), which is primarily used for higher quality magazines and catalogues, to receive support in the second half of next year, following "Stora Enso's planned closure of almost 1.1 million tonnes of CWF production capacity at its Oulu mill by the end of September 2020,' it added. 'We expect Sappi, UPM and Lecta S.A.to benefit the most from this development.'

Fiber-Based Packaging

Weaker trading conditions for top fiber-based packaging producers led to mixed reported results, however revenue held up fairly well, said Moody's.

Smurfit Kappa, for example, was able to 'significantly increase' its EBITDA in the period, by 11%, while Mondi reported an EBITDA increase of around 3% year-on-year.

Moody's added that macroeconomic challenges stemming from global trade tensions, coupled with the likelihood for weaker economic growth, are likely to persist for the remainder of this year, which in turn will put pressure on paper packaging producers' full-year operating results.

Corrugated Packaging

Corrugated packaging benefited from higher prices in the first half of the year, however the container board segment declined because of significantly lower pricing levels for testliner and kraftliner, Moody's said.

It expects pricing levels to stabilise during the second half of 2019, supported by expectations that the decrease in pulp prices will slow.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.