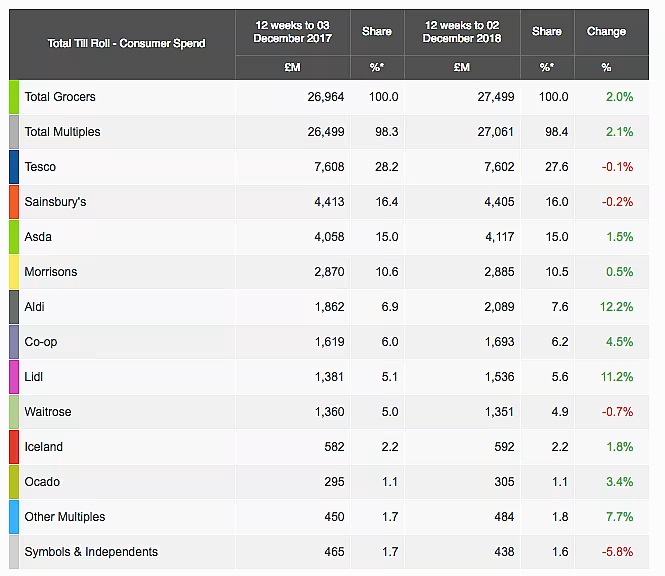

Asda remains the best performer of the UK’s ‘Big Four’ supermarkets, registering a 1.5% sales rise in the 12 weeks to 2 December, according to the latest market share figures from Kantar Worldpanel.

Asda sits on 15.0% market share – one percentage point behind Sainsbury’s (16.0%), which saw a 0.2% decline on sales in the period.

Tesco continues to lead the UK grocery market, with 27.6% market share, with the retailer seeing a marginal decline (-0.1%) in the period.

Morrisons rounds off the Big Four with 10.5% market share, seeing a 0.5% increase in sales.

Meanwhile, the discounters continue to perform well, with both Aldi and Lidl experiencing double-digit growth over the last 12 weeks.

“Boosted by a number of store openings in November, Aldi maintained its position as the fastest-growing supermarket and saw its market share rise by 0.7 percentage points, to 7.6%,” commented Kantar Worldpanel’s Fraser McKevitt.

“Lidl’s market share also jumped – up 0.5 percentage points, to 5.6% – with sales of the supermarket’s premium Deluxe line experiencing particularly strong growth of 24%,” added McKevitt.

Christmas Crackers

In terms of the coming Christmas period, Kantar Worldpanel said that despite challenges in the overall retail market, the fact that Christmas Day falls on a Tuesday will be of benefit to grocers.

“The last time Christmas Day fell on a Tuesday was in 2012, and the Saturday before was the busiest shopping day of the year,” said McKevitt. “We expect the same trend to hold true this year, with Saturday 22 December pulling in the last-minute Christmas crowds.

“Because of the way Christmas falls, grocers have an extra trading day this year, meaning: overall sales in December – up to and including Christmas Eve – could reach £10 billion. Despite an uncertain political climate taking its toll on consumer confidence, shoppers are still willing to spend that little bit extra on more expensive goods,” he added.

McKevitt also noted that consumers appear to be spending more on premium own-brand ranges, with “total premium own-label lines growing at 5.5%, which could lead to record sales in this price tier of £1.1 billion over the 12-week period.”

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.