The Euro 2020 football tournament helped keep UK grocery sales relatively high over the 12-week period to 11 July, the latest data from Kantar has shown, with sales up 10.9% compared to the same period two years ago.

Compared to the same period last year, at the height of the pandemic, sales were down 5.1%, however.

“It was a huge month for British football, with major tournaments usually providing a significant boost to supermarkets," commented Fraser McKevitt, head of retail and consumer insight at Kantar.

"But with many fans choosing to make the most of newfound freedoms and watch the matches in pubs and bars, take-home sales of alcohol over the four weeks to mid-July were actually down by 3% compared with the previous month. That said, shoppers still spent £1.2 billion on the category – a 24% increase on the same period in 2019."

According to McKevitt, sales of crisps and snacks brands were up 23% compared with the same period two years ago, while chilled and frozen pizzas saw sales up £10 million.

Online Shopping Declines

Due to the loosening of restrictions, the number of UK consumers shopping online fell by 81,000 in July, compared to the previous year, Kantar said, while digital baskets shrunk by 8%, to an average of £80 per shop, the lowest since before the pandemic.

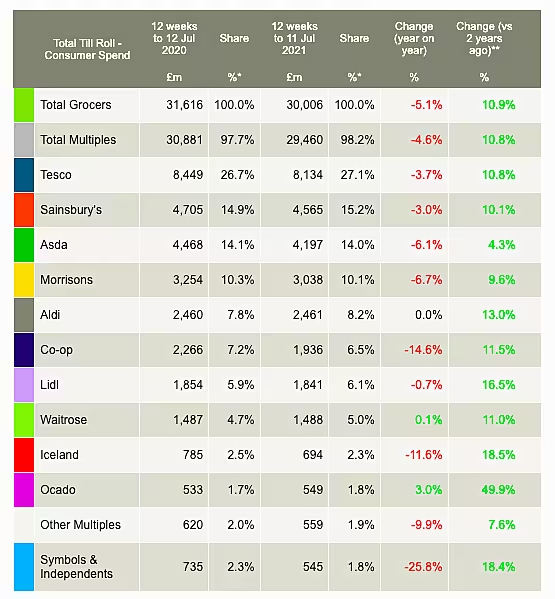

In terms of the performance of the UK's biggest grocers, all bar Aldi (0.0%), Waitrose (+0.1%) and Ocado (+3.0%) have seen their sales fall year-on-year, however most are up by double digits compared to the same period two years ago.

On the performance of Waitrose, McKevitt noted, "Waitrose lost shoppers last year when people focused more on picking up essentials and limiting trips outside the home. But as the nation becomes more confident and starts to buy groceries from multiple places again, it has outpaced its peers with increasing footfall and as a result its market share rose by 0.3 percentage points to 5.0%."

Last week, Waitrose, along with its parent John Lewis, announced a streamlining programme, which will see up to 1,000 management jobs cut.

UK Retail's 'Big Four'

Of the 'Big Four', while Sainsbury's has seen its market share increase on a year-on-year basis, Asda and Morrisons have both slipped back, by 0.1 and 0.2 percentage points respectively.

“Morrisons has made plenty of headlines this month following private equity interest in the business; a change of ownership in the near future looks to be highly likely," said McKevitt. "Following a year of solid sales performance, shoppers are clearly pleased with what the Bradford-based grocer has offered. It sets itself apart from the competition through its distinctive fresh counters and a continued use of multibuy promotions." [Picture: Picture credit ©jarino47/123RF.COM]

© 2021 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.