A new report from Moody's Investors Service has said that grocery operators will face challenges in maintaining margins in the future, as customers embrace online shopping.

The report, Top of Mind: Frequently asked questions about top global sectors, examined the most pressing issues facing major global industries, including retail, automotive, pharmaceutical, utilities and construction.

With regard to retail, the report anticipates that the 'ongoing shift towards online shopping and curbside pick-up will continue', both in grocery as well as other sectors.

It added, however, that spending changes between categories prompted by COVID-19 will likely be temporary, and vary from subsector to subsector.

Total Retail Sales

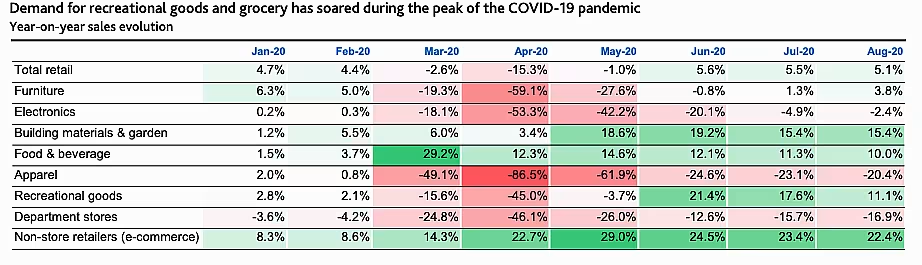

Total retail sales fell by 15.3% in April, the study found, which was the most severe month of pandemic lockdowns – the apparel industry saw a 86.5% drop in April, with furniture down 59.1% and electronics retail down 53.3%.

Food and beverage sales were up 12.3% in April, however, while e-commerce was up 22.7% – a key beneficiary of the lockdown trend.

In the most recent month for which data is available, August, total retail sales were up 5.1%, with most markets seeing signs of recovery. Food and beverage sales were up 10.0%, while e-commerce was up 22.4% for the month.

Moody's expects grocery sales growth to slow as we enter the new year 'as pantry loading subsides, normal buying patterns gradually return and restaurants and food service establishments regain their footing'.

Online Penetration

The firm said that online sales are likely to 'remain higher than they were before the pandemic', particularly in categories with historically low online penetration, such as food and beverage.

'This is because consumers have become increasingly comfortable with internet shopping,' it said. 'As growth slows, the longer-term credit challenge for grocers will remain how to preserve margins despite the rising adoption of lower-margin online shopping.'

The fact that many consumers will continue to work from home even after the pandemic is over is also likely to affect purchase preferences, with increased leisurewear spend at the expense of formal office attire, and lower department store traffic.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.