Grocery price inflation is now at its highest level for ten years, new data from Kantar has shown, hitting 5.2% in March 2022.

This is the highest level since April 2012, and is prompting consumers to increasingly switch to private label, which now accounts for more than half (50.6%) of all grocery spend.

In addition, 'round pound' price points, such as £1, £2 etc, are being ditched to combat rising prices, the research firm said, accounting for 15.9% of overall products, down from 18.2% last year.

Manage The Cost

“More and more we’re going to see consumers and retailers take action to manage the growing cost of grocery baskets," commented Fraser McKevitt, head of retail and consumer insight at Kantar. "Consumers are increasingly turning to own label products, which are usually cheaper than branded alternatives."

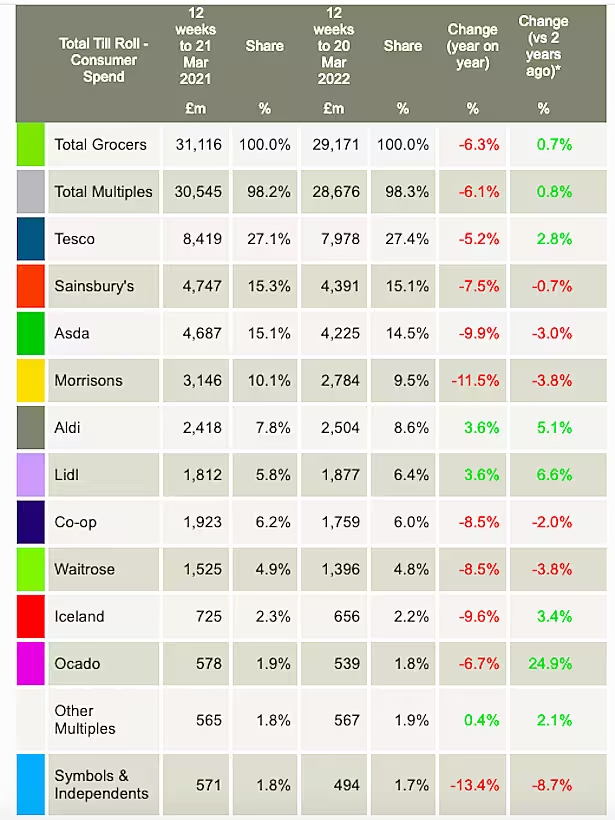

Supermarket sales fell 6.3% during the 12 week period to 20 March, Kantar said, and are up 0.7% compared to March 2020, when the first lockdown period began to take hold.

Online sales still remain elevated, accounting for 12.6% of the overall market, compared to 8% three years ago, an indication of the increased online capacity retailers have developed since the pandemic began.

“What we’re really starting to see is the switch from the pandemic being the dominant factor driving our shopping behaviour towards the growing impact of inflation, as the cost of living becomes the bigger issue on consumers’ minds," McKevitt added.

Read More: UK Retail Sales Growth Slows In March As Inflation Bites: CBI

Year-On-Year Growth

Looking at the performance of the UK's biggest grocers in the 12-week period, only two have achieved year-on-year growth due to tough comparatives.

Aldi saw its sales rise 3.6% year-on-year, with the discounter now boasting a market share of 8.6%, while Lidl, which sits on 6.4% market share, also reported a 3.6% year-on-year sales increase.

Aldi's record high performance was boosted by its ability to attract older shoppers, Kantar said, with a 16% increase in people aged over 55 buying from the grocer. Lidl, meanwhile, performed strongly in bakery and chilled convenience, with sales up 17% and 11% respectively.

The grocery sector continues to be led by Tesco (27.4% market share), which saw sales drop 5.2% year on year. This was a stronger performance than the rest of the 'Big Four', with Sainsbury's seeing sales down 7.5%, Asda down 9.9% and Morrisons down 11.5%.

© 2022 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.