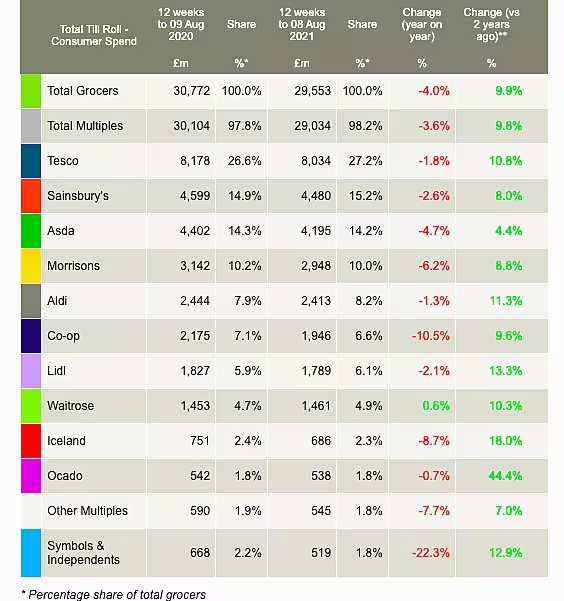

UK take-home grocery sales declined by 4.0% in the 12 weeks to 8 August, according to the latest data from Kantar, as shopping habits start to return to relative normality.

"In the past month grocery sales were just 0.5% lower than this time last year, the best four week ending market performance since April," commented Fraser McKevitt, head of retail and consumer insight at Kantar.

"In monetary terms at least, we seem to be in a similar place to 12 months ago, but if we dig deeper into the data we can see that our shopping habits are actually very different. With the end of social distancing restrictions, people have been happier to head into stores to make more regular, smaller shops.

According to Kantar, British consumers made an extra 108,000 shopping trips this month, while average basket sizes were 10% smaller.

Compared to the corresponding 12-week period in 2019, however, sales were 9.9% higher during the period.

Online Starts To Slow

With shoppers returning to the stores and increased consumer confidence, there is also evidence of a slowdown in the performance of online, however those that have become accustomed to using e-commerce services over the past year are continuing to do so, said Kantar.

"Those who have come to love the convenience of an online shop are sticking with it, ordering regularly and spending on average more than two-thirds of their total grocery bill online," said McKevitt. "But the unconverted are starting to drop away, preferring to get back to store instead.

"Just over 20% of the population bought groceries online in the latest four weeks, the lowest level we’ve seen since October last year, while the share of grocery sales made online now stands at 13.0%, down from a peak of 15.4% in February.”

This, in turn, has affected the performance of Ocado, which was one of the strongest performers during lockdown – the banner saw sales decline 0.7% in the 12-week period, the first time it has posted a decline.

That said, the group's sales are up 44.4% on the same period in 2019, which is the fastest growth in the UK grocery market.

Big Four Performance

Most of the UK's grocers reported year-on-year sales declines in the 12-week period; market leader Tesco (27.2% market share) saw its sales dip 1.8% compared to the same period last year, while Sainsbury's (15.2% market share) was down 2.6%.

Rounding off the 'Big Four', Asda (14.2% market share) saw its sales down 4.7%, and Morrisons (10.0% market share), which is currently in the midst of a takeover battle, was down 6.2%.

The only retailer to see its sales increase in the 12-week period was Waitrose, which grew by 0.6% as it attracted 365,000 more shoppers to its stores, according to Kantar.

According to McKevitt, while the return to stores is seeing many pandemic habits roll back, one trend that has persisted is the use of contactless payments – across major grocery retailers, 87% of payments are now made by card rather than with cash.

"As we shift to cashless payment methods, retailers have been looking to make purchasing as seamless as possible," he said.

"Amazon launched its new ‘just walk out’ stores, while Tesco announced last week that it is preparing to introduce its first till-less shop, and we anticipate more retailers will follow suit.”

© 2021 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.