Grocery sales dipped 5.9% in Ireland in the 12 weeks to 11 July due to the loosening of restrictions, Kantar has said, however sales levels are still well ahead (15.9%) of the corresponding period in 2019.

The average Irish household spent €189.98 more in the most recent 12-week period than in the same period two years ago, the research firm said.

Online grocery sales have also shown signs of retrenchment, declining for the second month in a row – down 6.1% in the most recent four weeks, according to Kantar.

This trend is most pronounced in urban areas, with online sales dropping 24% in Dublin over the past month, an indication that cities and rural areas may be emerging from the pandemic at a different pace. As recently as February, online grocery had hit record high levels in Ireland.

Visiting Restaurants More Often

“Whether you are a devoted football fan or not, Euro 2020 certainly provided a welcome excuse to head out to newly reopened pubs and restaurants and reconnect with friends and family," commented Emer Healy, retail analyst at Kantar.

"It meant take-home sales of classic pub snacks like crisps and nuts fell 1.6% and 2.9% respectively compared to the previous four weeks, and supermarket alcohol sales dropped by 1.5%. We’re not back to normal just yet though – with indoor hospitality still closed, shoppers spent €58.9 million more on take-home alcohol than before the pandemic in 2019."

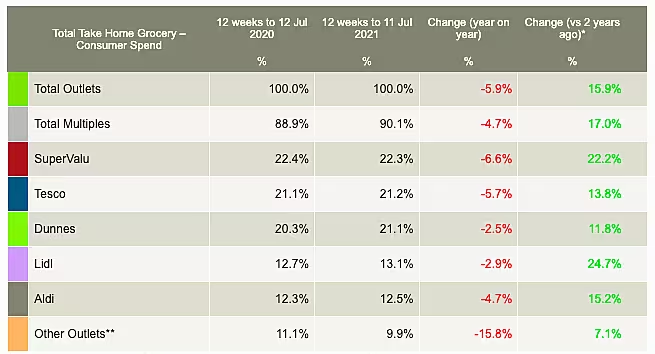

Retailer Market Share

In terms of the performance of Ireland's top grocers, SuperValu holds 22.3% of the market, with the retailer seeing a 6.6% decline in sales compared to last year (+22.2% compared to 2019).

Tesco, on 21.2%, is marginally ahead of Dunnes Stores, with 21.1%, with the latter seeing the lowest year-on-year decline (-2.5%) of any retailer in the study.

Dunnes continues to achieve the highest spend per buyer out of the retailers and its average household spent €558.64 in the past 12 weeks, according to Kantar.

Elsewhere, discounter Lidl holds 13.1% of the market, a new record high for the retailer. Aldi holds a market share of 12.5%.

© 2021 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.