The recent fuel supply crisis at British forecourts led to shoppers making fewer trips to the supermarket last month, Kantar has said, with take-home grocery sales dropping by 1.2% in the 12 weeks to 3 October.

Despite the dip, sales are still 8.1% higher than they were before COVID-19, Kantar added.

According to Fraser McKevitt, head of retail and consumer insight at Kantar, queues outside petrol stations meant that the average household made 15.5 store visits in the past four-week period, the lowest monthly figure since February.

"Shoppers staying off the roads also meant the proportion of groceries bought online, which has been steadily decreasing over the past seven months, crept up to 12.4% compared with 12.2% in September," he said.

In addition, shoppers tended to spend more when in-store, with the number of trips where shoppers spent £100 or more rising by 6%.

Christmas Sales Starting Early

There are also signs that British consumers are starting to prepare for Christmas, with Kantar noting that sales of Christmas pudding were 76% higher than at this time last year, while sales of toys were up 5% year-on-year, and gift wrap was up 10%.

"It’s important to say, however, that these are still relatively small numbers and anxiety around supply issues has not translated to panic buying – festive or otherwise," said McKevitt.

Performance Of Major Grocers

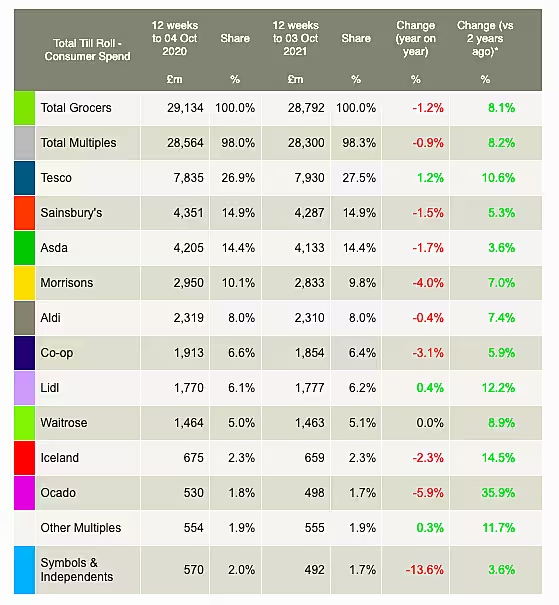

In terms of the performance of the UK's largest grocers, market leader Tesco saw a 1.2% increase in like-for-like sales in the 12 weeks to 3 October (+10.2% on 2019), making it the top performer of the UK's 'Big Four' grocers.

Tesco’s market share increased by 0.6 percentage points and now stands at 27.5%, the highest level since February 2019, Kantar noted.

Second-placed Sainsbury's saw sales down 1.5% year-on-year (+5.3% on 2019), while Asda was down 1.7% (+3.6% on 2019) and Morrisons was down 4.0% (+3.6% on 2019).

Elsewhere, Kantar said that consumer behaviour is continuing to 'creep back to pre-pandemic habits', meaning that some of the retailers that made significant gains last year are showing signs of returning to normal.

For example, convenience operator Co-op saw its share fell by 0.2 percentage points in the latest 12 weeks to 6.4%. Elsewhere, online retailer Ocado saw a drop of 5.9% this period, but has still demonstrated the greatest two-year increase of any retailer, with sales 35.9% higher than in 2019.

© 2021 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.