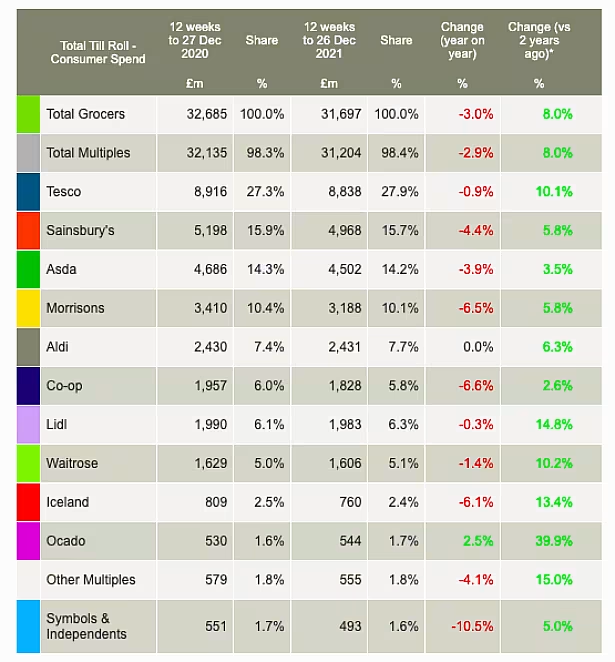

Grocery sales in the UK totalled £31.7 billion (€38 billion) in the 12 weeks to 26 December 2021, according to the latest figures from Kantar.

This was 3.0% down on the corresponding period the previous year, although it was up 8.0% on the same period in 2018.

Grocery sales hit £11.7 billion over the month of December alone, Kantar said, which is on a par (-0.2%) on the record sales recorded in December 2020.

"We can really see just how much spending accelerated in December compared with earlier in the year by looking at the average trend during March to November when sales were down by 2.5% against 2020," said Fraser McKevitt, head of retail and consumer insight at Kantar.

Grocery spend peaked on 23 December, Kantar said, as shoppers made the highest number of in-store visits to supermarkets since March 2020.

Premium Private Label Soars

Private label was a big beneficiary of this heightened spend during the Christmas period, with premium own-brand sales increasing 6.8% on the previous year, to £627 million, in the four weeks to 26 December.

“The appetite to celebrate and splash out that little bit more this year pushed sales of luxury own-brand products up across the board," said McKevitt. "Sparkling and still wine sales grew 22% and 18% respectively, while crisps surged by 31%. Tesco’s Finest and Sainsbury’s Taste the Difference are easily the largest premium own-label ranges, but we saw the fastest growth from other ranges such as Asda Extra Special and Iceland Luxury.”

Grocery Retailer Performance

In terms of the performance of the UK's major grocers over the festive period, Ocado (1.7% market share) was the only retailer to see a year-on-year increase in sales in the 12-week period, up 2.5%.

Elsewhere, discounter Aldi (7.7% market share) reported flat (0.0%) sales compared to last year.

Market leader Tesco (27.9% market share) has cemented its position at the top of the UK grocery market, with a 0.6 percentage point gain in market share since last year, the Kantar figures reveal.

Second-largest grocer Sainsbury’s now holds 15.7% of the market, with Asda on 14.2% and Morrisons on 10.1%.

Aldi, Lidl and Waitrose also grew their shares, by 0.3%, 0.2% and 0.1% respectively, according to the Kantar data.

Earlier this week, Springboard reported that footfall to UK retailers was down significantly in the week after Christmas, falling by a quarter compared to pre-pandemic levels.

© 2022 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.