Take-home grocery sales in Ireland increased by 24.7% in the 12 weeks to 14 June 2020, according to the latest data from Kantar.

The number of shopping trips increased by 2.3% in the period, as lockdown restrictions started to ease, with customers spending an additional €628.7 million on groceries.

However, customers continued to buy more than in normal times, with the average person spending €204 extra in June compared to the same period last year, or an average of €30.77 per trip.

'Cautious Optimism'

Retail analyst at Kantar, Emer Healy, commented, “There are indications of cautious optimism in Ireland. Despite the months of lockdown, 40% of Irish consumers say they feel financially comfortable and that’s reflected in how they are shopping.

“With some of the usual ways to treat themselves off-limits, they’re trading up to branded goods in-store, spending an additional €381 million on these products compared with last year.”

Healy added, ”People meeting friends and family outside of their home boosted sales of picnic favourites this month, as sales of dips were up 25%, soft drinks 42% and crisps 52%.”

Online Shopping

The data revealed that 99,000 households used online delivery services in the latest 12-week period.

Customers spent €70.9 million more in online grocery shopping in the period, which represents a 114.3% increase on a year-on-year basis.

However, 63.6% of shoppers said that they haven’t shopped online and do not intend on doing so in the future.

Healy explained, “Younger consumers appear to be holding back from online orders so that more vulnerable groups can benefit from them – taking heed of advice from the grocers.

“Nearly 40% of shoppers said this is the main reason they haven’t ordered groceries online during the lockdowns.”

Top Retailers

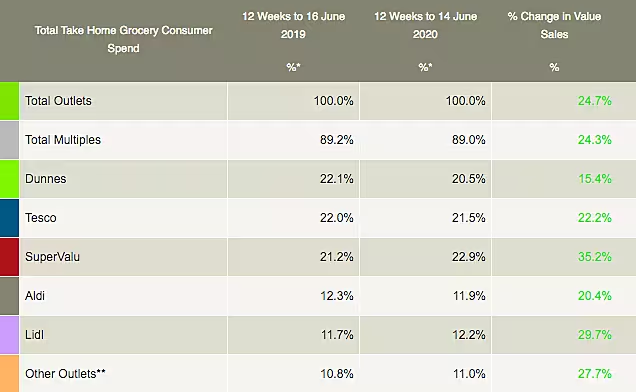

SuperValu emerged as the top retailer with the highest market share of 22.9% and sales growth of 35.2% in the latest 12 weeks.

The retailer benefitted from its large store network as consumers continued to shop from retailers closer to their homes.

Tesco occupied second position with a 22.2% growth in sales and a 21.5% market share, driven by an increase in consumer spending, which shoppers picking up around five additional items per visit.

The market share of Dunnes Stores for this period was 20.5%, with year-on-year sales growth of 15.4%.

Lidl boosted its sales by 29.7%, while Aldi’s sales were up 20.4% year-on-year.

More than 40% of Irish shoppers are now shopping closer to home, resulting in a 44.8% growth in sales across independent outlets during the 12-week period, data showed.

Overall, shoppers were more dependent on local suppliers and spent an additional €2.4 million at greengrocers and €11 million at butchers compared with the same period last year.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: The European Supermarket Magazine.