Irish grocers saw the ‘best month of the year’ to date, as sales increased by 6.4%, year on year, to €1.16 billion, in the four weeks to 3 November 2024, according to the latest data from Kantar.

Grocery inflation declined by 6.15 percentage points, to 3.3%, compared to the same period last year, data showed.

Volume sales increased by 5.4% in this period, as shoppers stocked up for Halloween and the bank holiday.

Irish households shopped more often in October, registering an increase of 2.6%, compared to last year.

Pumpkin sales increased by 4.5% (€63,000), while Brussels sprout sales surged by 43%, with shoppers spending an additional €149,000 on this traditional holiday staple.

Eimear Faughnan, head of retail at Kantar, explained, “October was an important month for Irish shoppers, as they prepared for the first school holiday of the new term and Halloween, enjoying above-average temperatures that delayed the need to don winter woollies.

“Shoppers stocked up on Halloween treats, spending a ‘frightening’ €8.9 million more than last year on chocolate confectionery, €2.4 million on savoury snacks, and €1.6 million on sweets – but it’s clear that Irish households are also preparing for the holiday season. Shoppers spent an additional combined €774,000 on flour, fruits and nuts, icing and cake mixes, as they ready their Christmas cakes.”

Other Trends

Shoppers spent an additional €40 million on deals over the latest 12 weeks, with the share of products sold on promotion sitting at 18.5%.

Branded products outperformed own-label products for the third consecutive period, resulting in a 2.6 percentage-point gap, as shoppers boosted branded value sales by 7%, Kantar added.

Online sales increased by 11.8%, year on year, as shoppers spent an additional €21.5 million on the channel.

Shopping trips also witnessed an increase of 16.5% in the latest 12-week period, adding €29 million to online sales.

Top Retailers

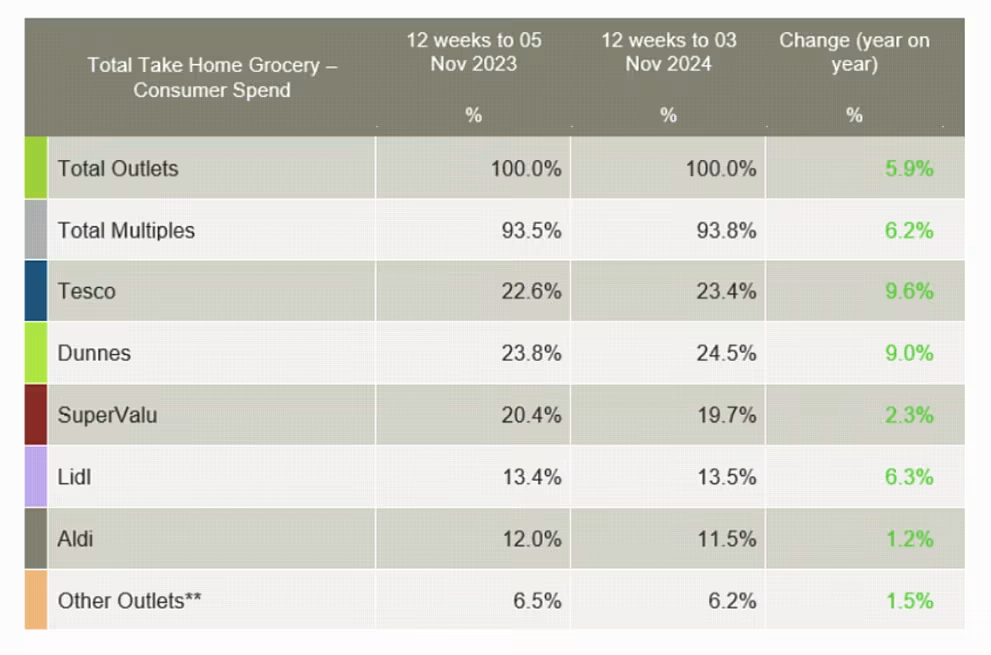

Dunnes Stores continued to dominate Ireland’s grocery retail landscape, with a market share of 24.5% and sales growth of 9%.

The retailer saw a 7.3% increase in shopping trips, adding €55.9 million to its overall performance.

With 23.4% of the market, Tesco emerged in second position, with value growth of 9.6%, year on year, as shoppers increased their trips to stores by 6.7%.

SuperValu held 19.7% of the market, with growth of 2.3%. Average shopping trips to the grocer were the highest, at 24.4, over the latest 12 weeks.

The increased number of shopping trips and additional items picked up per trip contributed €28.8 million to its performance, Kantar noted.

Lidl captured 13.5% share of total spending and experienced growth of 6.3% in this period.

It generated an additional €26.3 million in sales, compared to the same period last year, driven by increased store visits and a higher volume per trip.

Aldi witnessed growth of 1.2%, to reach a market share of 11.5%. Increased store visits added €16.4 million to its total sales.