Irish grocery price inflation hit 4.7% in the 12-week period to 17 April, its highest level since 2013, according to the latest data from Kantar.

Food inflation has impacted shopping budgets, with items like cooked poultry, bread, pasta, and butter seeing the the biggest jumps in prices.

Emer Healy, senior retail analyst at Kantar, commented, "The average household is facing a €330 price increase on their annual grocery bill, and 23% of households say they are now struggling to make ends meet when it comes to their weekly food shop."

"Retailers are responding to the rising price of goods, focusing their efforts on offering everyday low prices for shoppers," she added.

Grocery Trends

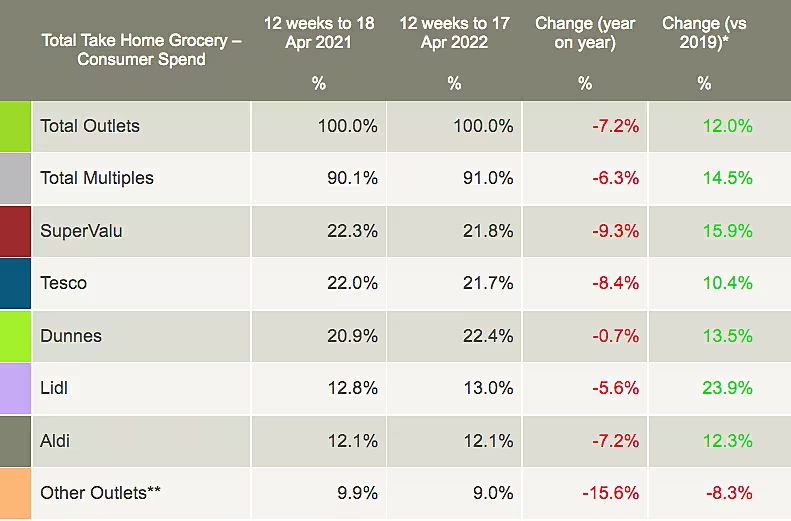

Take home grocery sales fell by 7.2% year-on-year, and by 5.2% compared with two years ago, data showed.

Healy added, "The number of supermarket trips made each month has continued to fall, with shoppers making 3.5 fewer visits on average than this time last year when COVID-19 restrictions were much tighter. The average spend per buyer has also fallen significantly by €144 as consumers eat more meals out of the home.

"On top of that, the types of items we’re buying have changed too. Sales of instant hot snacks and frozen pizzas are growing by 9% and 4.3% respectively over the last four weeks as shoppers turn to quick and easy meals now that many of us are back in the office and juggling school runs again."

This period also saw the first Easter in two years without social restrictions.

Shoppers spent €10.8 million more on Easter eggs and seasonal chocolate compared to the same period last year.

In addition, shoppers spent an extra €620,000 this year on hot cross buns – an Easter favourite.

Read More: French Consumer Spending Drops Amid Record High Inflation

Online Sales

Online sales increased 3.9% in this period, with shoppers an extra €2 million on the channel.

Emer Healy stated, "Many people became more reliant on online shopping over the course of the pandemic, and this has fitted in quite naturally with our busier schedules post-COVID. In the context of rising prices it also allows consumers to be more considerate as they add items to their basket.

"While people are buying less in stores, the average number of items being purchased online is actually on the rise, growing by 3.2% year on year."

The channel's market share is now 3.3 percentage points higher than the same 52 week period in 2019, Kantar noted.

Top Retailers

Dunnes Stores retained its position as Ireland’s largest grocer, with a 22.4% market share in the latest 12 weeks.

The retailer was boosted by the largest influx of new shoppers in this period, who contributed an additional €56.8 million to its overall performance.

With a market share of 21.8%, SuperValu placed second, closely followed by Tesco with a 0.1 percentage point difference at 21.7%.

Lidl and Aldi accounted for 13.0% and 12.1% of the market, respectively.

© 2022 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: European Supermarket Magazine.