Irish grocery retailers witnessed a 13% year-on-year increase in shopper footfall – the highest level since March 2020 – in the four weeks to 19 March, according to latest data from Kantar.

In this period, value grocery sales increased by 13.3%, up from 10.2% in February, as the average price per pack increased by 13.8%.

This increase was driven by a month of celebrations, including Mother’s Day, St Patricks Day and the Irish rugby team winning the Six Nations Grand Slam.

'A Busy Month'

Emer Healy, senior retail analyst at Kantar commented, "March was a busy month for Irish consumers with plenty of events and opportunities to celebrate. We also welcomed longer, brighter days, so we saw shoppers visiting stores more often.

“Although value sales are up significantly, grocery price inflation is still the driving factor rather than just increased spending. Grocery inflation continues to rise and now stands at 16.8%, with the annual grocery bill set to rise by €1,211 if consumers don’t make changes to their shopping habits."

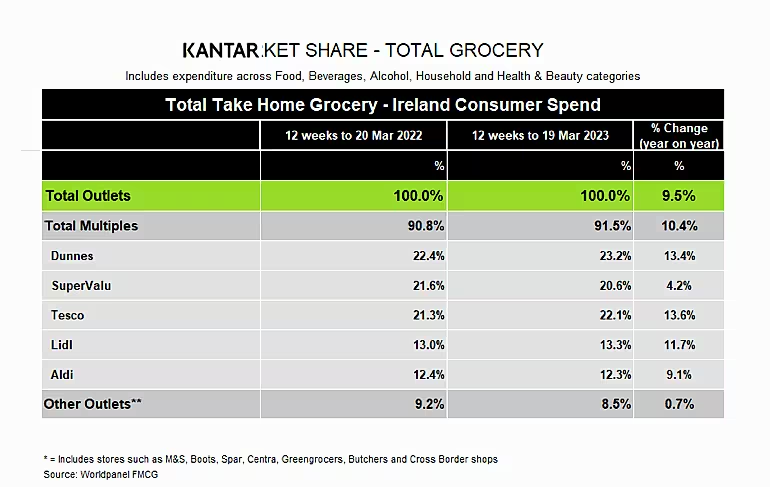

In the 12 weeks to 19 March, take-home grocery sales increased by 9.5%, contributing an additional €268 million to the overall market performance, as shoppers returned to store more often (up 7.7%) and average price per pack increased by 13.9% year on year, Kantar noted.

“Consumers are opting to shop little and often to help manage their household budgets. Basket mission really drives growth for the overall market – up 25.1% – with shoppers spending an additional €119.6m year-on-year. The indulgent mission grew 17.7% year-on-year, as shoppers made more indulgent trips in line with the festivities in March,“ Healy added.

Festivities And Celebrations

In March, sales of Guinness increased by 6.7%, equating to an additional €623,000 in spend, with one in 10 Irish households purchasing the beverage as consumers celebrated St Patrick's Day.

People also consumed more savoury snacks and soft drinks, with sales hitting €3.5 million and €4.4 million, respectively, as many tuned in to watch Ireland win the rugby Grand Slam.

Customers also stocked up on Easter essentials, with the Easter chocolate category seeing 20% growth.

Sales of large eggs increased 86% year on year, with shoppers spending an additional €3.8 million.

Read More: Easter To Generate Retail Sales Worth €2.2bn In Germany, Notes HDE

Private-Label Sales

In the latest 12 weeks, the sales of private-label goods saw 13.5% growth compared to branded goods at 6.2%, the data showed.

Value own-label lines saw the strongest growth (34.5%) year-on-year, with shoppers spending €18 million more on these ranges. At 47.3%, own label now holds a higher value share than brands (47%).

Online sales increased 2.6%, with shoppers spending an additional €3.9 million on this channel.

More frequent trips (4%) and higher average prices (15.5%) helped to drive growth, Kantar noted.

Ireland's Top Retailers

Dunnes Stores emerged as Ireland's top retailer in the 12-week period, with a 23.2% market share, registering a sales increase of 13.4% year on year.

This growth was driven by an influx of new shoppers as well as shoppers returning more often.

Tesco held on to the second position with a 22.1% market share and sales growth of 13.6% year on year.

With a market share of 20.6% and growth of 4.2%, SuperValu secured the third position.

Shoppers made the most trips to SuperValu stores compared to all retailers, with an average of 21.7 trips over the latest 12-week period. The retailer reported a sales increase of 12.1% year-on-year.

Lidl's market share stood at 13.3%, with year-on-year sales growth of 11.7% as new shoppers and more frequent trips contributed an additional €25.2 million to its overall performance.

Elsewhere, new shoppers and more frequent trips contributed an additional €40.1 million to Aldi's overall performance, taking its market share to 12.3%. Sales were up 9.1% year on year.

© 2023 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: European Supermarket Magazine.