Take-home grocery sales in Ireland saw an increase of 4.7% in the four weeks to 12 May 2024, as shoppers indulged in products to enjoy the good weather around the May bank holiday, according to the latest data from Kantar.

In this period, shoppers spent an additional €614,000 on sausages, €497,000 on chilled burgers and grills, €454,000 on chilled prepared salads, and €3.4 million on soft drinks.

Elsewhere, sales of beer and wine increased by 4.1%, with shoppers spending an additional €2.7 million, compared to the previous month.

Volumes per trip during the four weeks were up slightly, at 0.2%, while frequency was also up, by 1%, with shoppers making 21 trips, on average, in this period.

Grocery Inflation

Grocery price inflation continued to drive increased sales, despite a significant increase in value sales, Kantar noted.

In the 12 weeks to 14 May, grocery inflation stood at 2.6%, registering a decline of 13.3%, year on year.

Emer Healy, business development director at Kantar, explained, “Once again, we see grocery inflation fall for the 13th month in a row – now sitting at the lowest level we have seen since March 2022. This is welcome news, but Irish consumers are still looking for bargains, with over 25% of value sales on promotion – down 4% since January 2024.

“Retailers are also promoting their own-label ranges to get shoppers through the door. Sales of own-label are performing well and growing ahead of the total market, at 5.7%, year on year, with shoppers spending an additional €86 million, year on year.”

Sales of premium own-label products increased by 12.6%, year on year, as shoppers spent an additional €18.4 million in the category.

Brands witnessed a 4% increase over the latest 12 weeks, as shoppers spent an additional €59 million, however, the category’s growth was slightly behind the total market growth of 5.7%.

Online grocery sales increased by 18.6%, year on year, with shoppers spending an additional €31.3 million in the channel.

Larger trips contributed an additional €12.5 million towards online sales, while new shoppers and more frequent trips generated a combined total of €9.8 million, the data showed.

Top Retailers

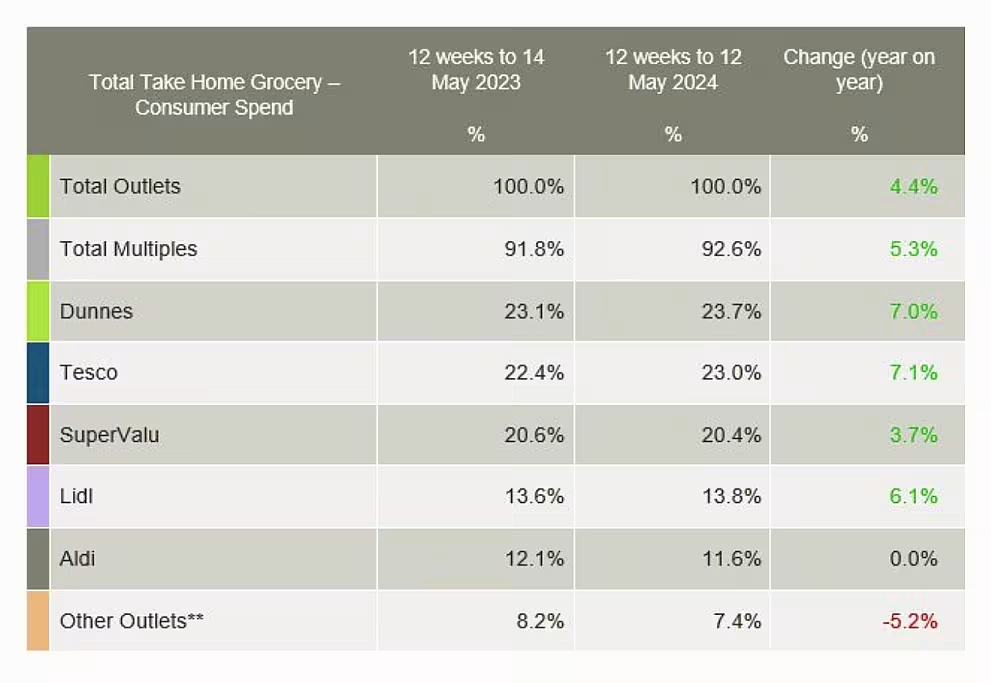

Dunnes Stores emerged as Ireland’s top retailer, with growth of 7%, year on year, in the latest 12 weeks, to hold a market share of 23.7%.

Its growth was mainly driven by more frequent trips, which increased by 4% in this period and contributed €29.7 million to its overall performance.

Tesco retained second position, with 23% of the market and year-on-year growth of 7.1%.

Trip frequency increased by 8.7%, year on year – the strongest among all Irish retailers – contributing an additional €61.2 million to its overall performance.

SuperValu ranked third, with 20.4% of the market and growth of 3.7%.

Lidl’s market share stood at 13.8%, with growth of 6.1%, year on year.

Aldi held 11.6% of the market, with new shoppers and more frequent trips contributing an additional €15.4 million to its performance.