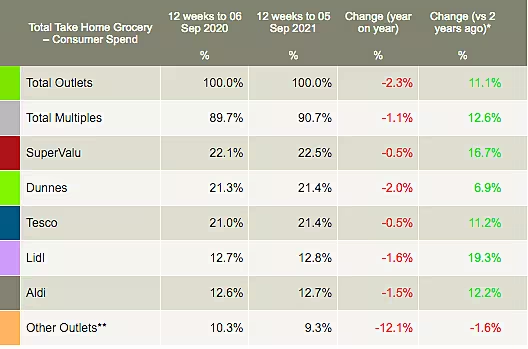

Grocery sales in Ireland saw a 2.3% year-on-year decline in the latest 12 weeks to 5 September, as people slowly returned to their pre-pandemic routines, according to the latest data from Kantar.

However, sales were 11.1% higher compared to the same period in 2019.

'Winds Of Change'

Emer Healy, retail analyst at Kantar, commented, “While we’re a way off a full return to normality, there are winds of change and people are becoming more comfortable heading out and about.

“An extra 189,000 trips were made to the supermarket over the past three months, driven by shoppers running out for one or two items at a time rather than relying on a big weekly shop like they did during the height of lockdowns. It suggests that the high vaccination levels across the country are helping to boost consumers’ confidence.”

The report also revealed that shoppers opted for bigger stores over smaller convenience retailers, which translated as market share gain for all big five retailers – a first since 2018.

Online sales dropped by 12.3% in the past four weeks as people returned to workplaces, education, and eating out.

Healy added, “It’s been a busy time for Irish households all over the country and preparing meals from scratch, a popular pandemic pastime, has slipped down the agenda.

“Shoppers switched home cooking staples for more time-efficient options, spending €7.5 million more on chilled convenience items like pizzas and ready meals over the past four weeks. Parents were also stocking up on lunch box favourites like children’s biscuits, bread and cooked meats, which grew by 11.3%, 7.6% and 14.6% respectively.”

In the 12 weeks to 8 August, grocery sales in Ireland dropped 3.9% year-on-year as people ventured back to offices, and coffee shops and indoor dining resumed for fully vaccinated people.

Top Retailers

SuperValu retained its spot as Ireland’s top retailer with a 22.5% market share.

Its performance was driven by consumers visiting the store 7% more often than they did in the same period last year, registering the highest shopper frequency among all retailers. This led to a sales boost of €43 million for the grocer.

Dunnes Stores saw the greatest influx of new shoppers (+5.3%) among all the retailers, contributing to sales worth €32 million.

Dunnes and Tesco emerged as the second-largest grocer, with both holding a 21.4% share of the market.

Tesco, which gained 0.4 percentage points market share, was particularly successful in terms of branded products, which grew by 2.9% to buck the overall market decline in branded sales in this period.

Aldi witnessed its highest ever market share this period of 12.7%. In addition, it gained a significant number of new shoppers over the past three months, which boosted sales by €1.6 million year on year.

Lidl’s market share for the period stood at 12.8%, data showed.