Sales growth in the Irish grocery market slowed to 1.9% in the 12 weeks ending 18 April, while spending remained 19.4% higher than pre-pandemic levels, latest data from Kantar has revealed.

The average household grocery bill was €245.10 higher in the latest 12 weeks compared to 2019.

Sales declined by 3.3% in the latest four weeks compared with the same period last year when Irish shoppers were preparing for the first national lockdown and bigger shopping trips generated record-breaking sales for the supermarkets.

Emer Healy, retail analyst at Kantar, commented, “It’s hard to believe that we’ve been living with restrictions for over a year now, and it means grocery market growth will fluctuate in the coming months as we compare sales against the different stages of lockdown in 2020.”

Ireland witnessed signs of growing consumer confidence in April as shoppers ventured out more often and visited the supermarket an additional 3,992,538 times in the past four weeks compared with the same time last year.

“The mostly vaccinated over 65s are leading the return and increased their visits to brick-and-mortar stores by 13.7% compared with this time last year - ahead of the national rate of 8.9%,” Healy added.

Online Sales

The demand for online groceries softened as the channel recorded its lowest growth in a year of 29.3% in the latest four weeks.

Online grocery accounted for 5.6% of sales in the past 12 weeks – up from the pre-pandemic level of 2.5% – and 16.5% of Irish households placed an order during this period.

Healy stated, “It’s clear that people are itching to get out and about and visit stores again, but that doesn’t mean completely waving goodbye to their new online shopping routines anytime soon.

“With all retailers now offering some form of digital service, either directly or through partnerships with delivery platforms, many shoppers have been converted to the ease of online grocery long term and will continue to balance it with smaller in-store shops in the future.”

Irish shoppers spent an additional €5.5 million on roast beef and €6.5 million on vegetables as it spent its second Easter in lockdown.

Sales of chocolate Easter eggs increased by 17.4% compared with 2020, while premium eggs saw sales jump by 21.7%.

SuperValu and Lidl benefited from consumers wanting to treat themselves, as more than a third of the basket was comprised of treats such as alcohol and confectionery.

At SuperValu and Lidl, these indulgent shopping trips increased by 19% and 21.5% year-on-year, respectively, data showed.

Top Retailers

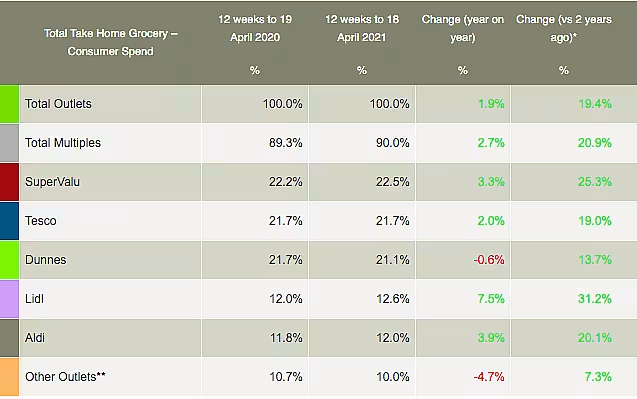

SuperValu retained the largest share of the grocery market at 22.5%, its highest level since June of last year.

Tesco saw sales up by 2.0%, as it attracted new customers through its doors, boosting sales by €1.1 million.

Dunnes Stores accounted for 21.1% of grocery sales in this period.

The retailer’s share of alcohol sales drop by 2.8 percentage points in the past 12 weeks as new regulations restricting alcohol promotions through customer loyalty schemes came into force.

Lidl gained from consumers making extra, smaller shopping trips, Kantar added.

Aldi held 12.0% of the market as shoppers continued to pick up additional items in its stores.

© 2021 European Supermarket Magazine. Article by Dayeeta Das. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.