Take-home grocery sales growth in Ireland slowed to 13.7% in the latest three month period, according to Kantar, with shoppers spending an additional €19 million on groceries in August due to local lockdowns.

The strongest regional growth was observed in Dublin, with shoppers spending €141 million more on groceries compared to the same period last year.

Retail analyst at Kantar, Emer Healy, commented, “Grocery sales over the past 12 weeks (to 6 September) remain significantly higher than pre-pandemic levels, but compared with April and May, shopping routines are much closer to what we would usually expect.

“An additional €19 million spent on groceries during the past month coincides with the start of a number of local lockdowns. This suggests that local restrictions are already making their mark – with people in certain parts of the country spending more to stock up on food and drink to consume at home.”

Outstanding Categories

Sales of branded goods increased by 18% year-on-year in the 12-week period, outpacing private-label sales.

Shoppers spend an additional €205 million on branded groceries, the report said.

In addition, sales of branded goods grew by 48% and 36% respectively in Lidl and Aldi.

Online retained its popularity during this period, registering a growth of 121.7% in the latest four weeks.

Healy stated, “This represents another month of record-breaking growth for the online channel, with digital sales adding €72.9 million to the total market in the latest 12 weeks.

"New shoppers accounted for almost a quarter of the €133.6 million spent on online groceries during that time.”

Top Retailers

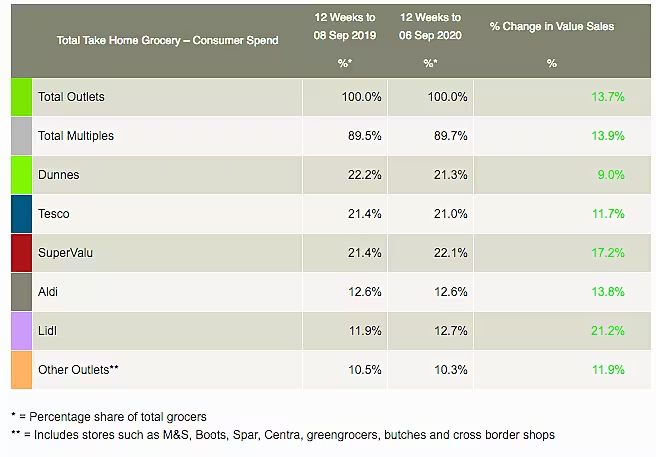

SuperValu claimed the highest market share, of 22.1%, in the period, with a 17.2% sales growth, driven by comprehensive online offers.

Dunnes Stores took second place with a 21.3% market share, followed by Tesco on 21%.

The report added that Dunnes cashed in on the back to school trend as households with children increased their in-store spending by 9%.

“With many returning to the school run and the office commute, easy and convenient dinners are firmly back on the menu," said Healy.

"Shoppers spent an additional €6.8 million on chilled convenience products, €2.7 million on ready meals, and sales of frozen prepared foods soared by €9.7 million year-on-year.”

Tesco’s performance was driven by higher average prices and larger trip size, the report highlighted.

In terms of sales growth, Lidl saw the highest increase of 21.2% year-on-year, amounting to €63.3 million.

Aldi’s market share of 12.6% for the period was driven by an increase in volume per trip and higher average prices, Kantar added.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: The European Supermarket Magazine.