The sales of take-home grocery in Ireland registered a 23.2% growth in the 12 weeks to 12 July 2020, with shoppers spending an additional €577.7 million, according to the latest data from Kantar.

The study also noted that consumers are showing signs of returning to pre-lockdown shopping habits after easing of coronavirus restrictions and reopening of non-essential retail.

Retail analyst at Kantar, Emer Healy, said, “We are beginning to see some people cautiously return to pre-COVID-19 habits.

“Grocery sales growth over the latest four weeks slowed to 17.8% as shoppers started to spend less on food for their fridge and more on eating and drinking out. But while some trends are reversing, it appears that others are here to stay.”

Popular Products

The sales of savoury snacks and confectionery grew by 45% and 35% respectively during this period, as more shoppers continued to opt for items for in-home consumption.

Healy added, “Brands outpaced own-label alternatives and an additional €345 million was spent on household names in the latest three months.

“Homegrown Irish brands like Barry’s Tea, Keelings, Kelkin and Keogh’s all experienced a sales boost as shoppers turned to much loved classics.”

The sales of alcohol in supermarkets saw a 76% increase in the latest 12-week period as people opted to drink at home due to limitation on group size and time allowed at pubs and restaurants.

Grocery sales through online platforms soared by 123% year-on-year as more people opted for the channel.

Emer Healy stated, “It goes without saying that lockdown had a major role to play in driving more shoppers to try online grocery shopping, and it looks like the boom is set to continue. An additional 75,000 shoppers purchased groceries online over the past 12 weeks, contributing €38.9 million to the channel.”

Top Retailers

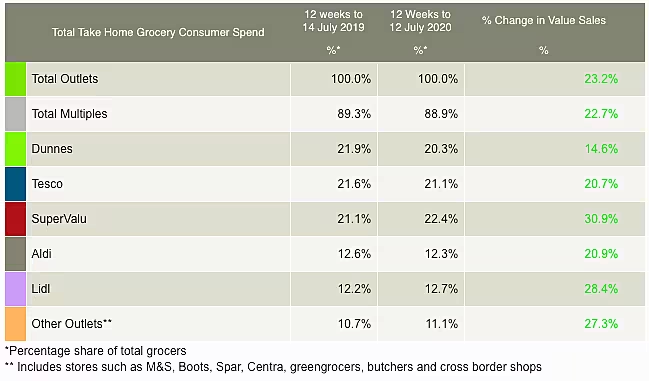

SuperValu claimed the biggest market share (22.4%) for the fourth month in a row and saw sales rise by 30.9% in the latest 12 weeks, Kantar added.

Aldi saw a 20.9% year-on-year growth in sales, driven by the sales of branded groceries increasing by more than a half during this period. Its market share stood at 12.3%.

Tesco reported a sales growth of 20.7% with a market share of 21.1%, while Dunnes stores saw a 14.6% jump in sales and a 20.3% market share.

Lidl recorded its highest-ever market share of 12.7% during this period, with sales growing by 28.4%.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: European Supermarket Magazine.