Grocery sales in Ireland increased by 8.5% in the four weeks to 1 October 2023, with store visits up 5.9% and shoppers making an average of 20.5 trips, according to the latest data from Kantar.

However, volumes per trip dropped by 7.3% compared to last year as shoppers continued to look for ways to manage household budgets.

Grocery price inflation, which stood at 10.5% in the 12 weeks to 1 October, is the main driving factor behind the rise in value sales, rather than increased purchasing, Kantar added.

Over the 12-week period, average prices rose by 8.7% year-on-year.

'Welcome News'

Emer Healy, business development director at Kantar commented, "It’s more welcome news for shoppers that inflation has fallen for the fifth month in a row – from last month’s 11.3%. Although there is promise in the current trajectory and this marks the lowest level of inflation we have seen since September 2022, the fact is that inflation still remains high."

Healy added, "There is currently a drop in the level of sales sold on promotion. Back in 2020, 27.7% of sales were on promotion versus 24.4% this year."

Other Trends

The average annual grocery bill is projected to rise by €176, from €1,677 to €1,853, given the current level of inflation in the market.

Sales of own-label goods increased 11.5% in the latest 12 weeks compared to brands, which saw growth of 5.1%.

Value own label ranges saw strong growth (up 13%) as Irish shoppers spent an additional €7.7 million year-on-year on the category to save money and control their spending.

Elsewhere, sales of winter staples were put on hold for a month due to warmer than usual weather, Kantar noted.

Shoppers spent an additional €860,000 on chilled burgers and grills, €538,000 on chilled prepared salads, and €2.4 million on ice cream.

Shoppers also spent an additional €3.9 million on take-home confectionery ahead of Halloween.

Online Sales Rise

Online sales grew 25.2% year-on-year in the latest 12-week period, with shoppers spending an additional €36.1 million online.

New shoppers venturing into the channel resulted in a 1.8-percentage-point increase in online shoppers, while existing shoppers increased their online trips by 5.6%.

Around 18% of Irish household’s now purchase their groceries online, data showed.

Top Retailers

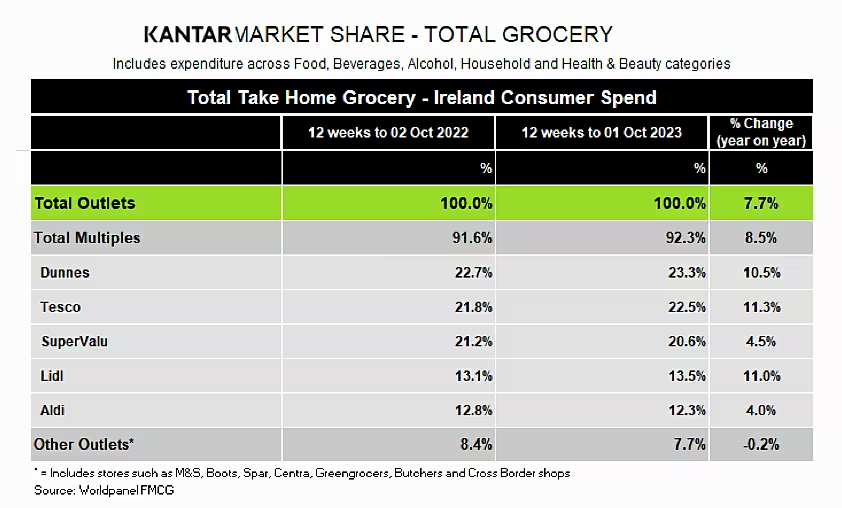

Dunnes Stores retained its position as Ireland's top retailer, with a 23.3% market share and growth of 10.5% year-on-year, driven by a 3.24-percentage-point increase in new shoppers.

With a market share of 22.5%, Tesco placed second and registered growth of 11.3% year-on-year.

Tesco witnessed the strongest frequency growth among all retailers, up 15.8% year-on-year, which contributed an additional €94.1 million to overall performance.

SuperValu secured third spot with 20.6% of the market and growth of 4.5% – a 0.5-percentage-point increase compared with the previous month.

SuperValu shoppers made the most trips in store, compared to other retailers (an average of 21.7 trips), and picked up more volume per trip, contributing an additional €5.9 million to its overall performance.

Lidl's market share stood at 13.5%, with the discounter seeing growth of 11% year on year.

More frequent trips contributed an additional €43.2 million to its overall performance.

Aldi saw growth of 4% and market share of 12.3%, as new shoppers and more frequent trips contributed an additional €27 million to its overall performance.