Take-home grocery sales in Ireland registered a 3.4% increase in the four weeks to 9 June, with store trips going up by 1.5%, according to the latest data from Kantar.

Sales of barbecue products were impacted by the ‘milder-than-usual’ weather, Kantar added, while there was an increase in demand for soups and home-baking items, which added €1 million and €500,000 to the tills, respectively.

Average prices increased by 1.3%, while volume per trip declined by 1.2%, compared to the same period last year, and reversed from last month’s marginal increase of 0.2%.

Emer Healy, business development director at Kantar, explained, “With less-than-typical sunny weather this June, it meant shoppers were not cracking open the barbecues or dining outdoors.

“As a result, they spent a combined €1.6 million less on chilled salads, burgers, grills and sausages than this time last year. We did see some bank holiday weekend indulgence, with sales of savoury snacks, confectionery, and beer and lager up 16%, 11.9% and 13.1%, respectively.”

Consumer Trends

Grocery inflation for the 12 weeks to 9 June stood at 2.5% – down by 13 percentage points versus June 2023 – reaching its lowest level since March 2022.

However, consumers in Ireland continued to remain price-conscious and allocated over one quarter (25%) of their expenses to promotional products.

Sales of own-label products grew ahead of the total market, at 4.9%, year on year, with a value share of just over 48%. Shoppers spent an additional €73.5 million on the category, year on year, data showed.

Premium own-label brands continued to perform well, growing by 11.4% compared to the same period last year, as shoppers spent an additional €16.8 million on these lines.

“The great news is that Irish consumers value home-grown brands. Our latest Brand Footprint report shows that four out of the top five most-chosen brands in Ireland are Irish brands, with the average Irish household buying a portfolio of 77 FMCG brands a year – well above the global average of 66. This shows clearly how brands are still an important choice for Irish consumers,” added Healy.

Sales of branded groceries also witnessed an increase of 3.9% in the latest 12 weeks, as shoppers spent an additional €57.9 million on the segment.

Online sales increased by 16.3%, year on year, with shoppers spending an additional €26.6 million on the channel.

Moreover, larger trips contributed an additional €8.9 million, with more frequent trips contributing €12.4 million to its growth.

Top Retailers

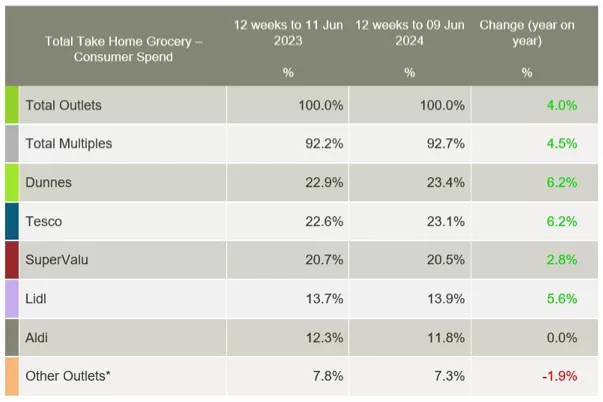

With a market share of 23.4% and growth of 6.2%, year on year, Dunnes Stores maintained its position as Ireland’s top retailer.

The business was boosted by more frequent and larger trips, which contributed a combined €20.8 million to its overall performance.

Tesco retained its second position, with a market share increase of 6.2%, year on year, to 23.1%.

The retailer saw a strong increase in trips to stores, of 7.2%, year on year, which contributed an additional €51.1 million to its overall performance.

SuperValu placed third, with market share growth of 2.8% to 20.5%.

At an average of 21.6 trips, the retailer witnessed shoppers making the most number of trips to its stores.

The company also saw the strongest growth in volume per trip (up by 8.3%) among all Irish retailers.

It was also the only retailer to attract new shoppers into its stores in the latest 12-week period, contributing a combined €66.3 million to its overall performance.

Lidl’s market share stood at 13.9%, with year-on-year growth of 5.6%, while Aldi held 11.8% of the market.