Grocery sales in Ireland slowed after a 'record-breaking' festive period, registering a 2.2% increase in the four weeks to 21 January 2024, according to the latest data from Kantar.

Despite a slowdown in sales, shoppers spent an additional €21.4 million in this period compared to last year, data showed.

In the 12 weeks to 21 January 2024, grocery inflation stood at 5.9%, which is down 1.2 percentage point compared to 7.1% in December.

Emer Healy, business development director at Kantar, commented, “Many Irish consumers are keeping a very close eye on their purse strings after indulging over the festive period, and to help manage household budgets, many are trading down to supermarket’s own-label products and looking for deals.

“The amount of sales on promotion has grown by 9.9% year-on-year with shoppers spending €92.6 million more than last year, meaning that 28.9% of all value sales this period were on promotion.”

Sales of own-label products grew ahead of the market at 8% year on year, with value share of 44.9% and shoppers spending an additional €117 million year on year.

Shoppers spent an additional €157 million on premium own-label ranges, which registered growth of 10.3% when compared to the same period last year.

Sales of branded products grew by 5.2% in the latest 12 weeks, which is slightly behind the total market, Kantar noted.

Shopping Trends

As shoppers prioritised health in the new year, alcohol sales fell by 8.6% and shoppers spent €7.4 million less in January compared to last year.

Sales of non-alcoholic beverages jumped 8.9% as shoppers spending €125,000 more year on year.

Around 7% of Irish households purchased non-alcoholic beverages, which resulted in a volume increase of 3.9% in this period.

In contrast, the sales of chilled or frozen plant-based products fell 2.6% in January, with shoppers spending €200,000 less compared to last year, data showed.

Shoppers opted for ease when adjusting to routines after the festive break, and this trend reflected in an additional expenditure of €3.3 million on chilled convenience.

Online sales increased 17.7% year-on-year in the 12 weeks to 21 January, witnessing growth of 17.7% year-on-year and shoppers an additional €28.2 million on the channel.

This growth was driven by more frequent trips, which contributed an additional €12.7 million to its overall performance.

Data showed that 18.5% of Irish households purchased groceries online with volume up 0.8 percentage points year-on-year.

Top Retailers

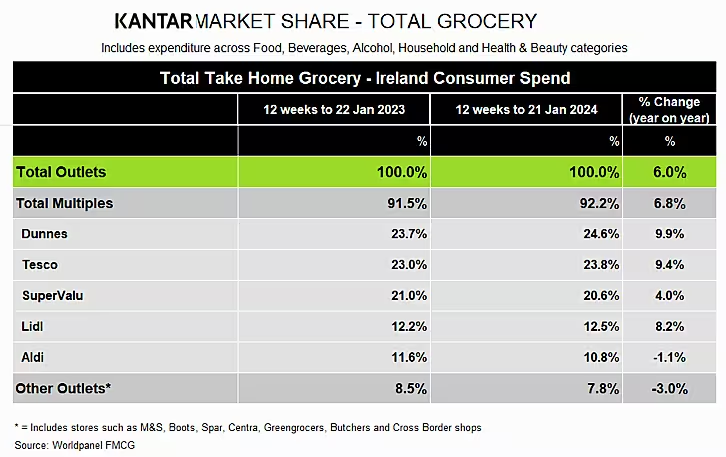

Dunnes Stores, Tesco and Lidl grew ahead of the total market in terms of value this month, Kantar noted.

Dunnes Stores registered growth of 9.9% year-on-year to hit a new record with close to a quarter of the total market share (24.6%).

Its performance was driven by a boost in new shoppers, up 1.3 percentage points year-on-year which is the highest in new shoppers among all the retailers and more frequent trips, which contributed a combined additional €38.1 million to its overall performance.

Tesco retained the second position with 23.8% of the market, also a new record for the retailer, with growth of 9.4% year-on-year.

The retailer saw the strongest growth in the frequency of trips amongst all the retailers, up 11.8% year-on-year, which contributed an additional €88.4 million.

SuperValu's market share stood at 20.6% with growth of 4%. Shoppers made the most number of trips to its stores (an average of 21.1), contributing an additional €9.4 million.

Lidl held 12.5% share of the market with growth of 8.2% year on year as more frequent trips contributed an additional €30.9 million.

Aldi held 10.8% share, with more frequent trips and new shoppers contributing an additional €5.9 million.