Take-home grocery sales in Ireland increased by 7% in the four weeks to 4 August 2024 as shoppers enjoyed a summer of sport, with the Olympic Games in Paris and the All-Ireland finals taking place.

Shopping frequency rose by 4.7%, along with an increase in average prices of 2.9%, according to the latest data from Kantar.

Business development director at Kantar, Emer Healy, stated, “Despite ongoing financial pressures on consumers, this month gave us a reason to celebrate. While we enjoyed some long-awaited good weather, we also cheered on our Olympic athletes.

“Bringing home four gold medals [...] gave us a reason to raise a glass or two and enjoy the sporting spectacle, with shoppers spending an additional €8 million on alcohol and €5 million on take-home confectionery and savouries combined.”

Shoppers also indulged in BBQs, spending an additional €367,000 on sausages and burgers and grills, €254,000 on ice cream, and €416,000 on mineral water compared to July 2024.

With back-to-school looming, some lunchbox staples also saw growth over the last month, with cheese, bread and morning goods up 5.6%, 3.8% and 3.3%, respectively, Kantar added.

Shoppers Look For Value

Despite an increase in the frequency of shopping, the number of packs per shopping trip fell 2.4% compared to last year, as shoppers continued to shop little and often.

Grocery inflation levels in the latest 12-week period to 4 August increased slightly to 2.8% – the lowest level since March 2022, and down 9.7% compared to August 2023.

Healy added, “Although grocery inflation is lower now, shoppers are still looking for value in the market and spending on promotions rose by 10.8% compared to the same time last year, with 24.5% of all value sales going through on promotion.

“Shoppers will always look for the best value and make the most of the wide range of promotions offered by retailers to help manage household costs.”

Other Trends

Shoppers spent an additional €59.2 million year-on-year on own-label products in the latest period, helping to grow the market by 4%, data showed.

Sales of premium private-label ranges increased 9.4% compared to the same period last year, with shoppers spending an additional €13.5 million on the category.

Branded goods grew ahead of the total market, up 7.7%, as shoppers spent an additional €111 million compared to the year-ago period.

The online channel saw sales up 11.5% year on year, with shoppers spending an additional €18.9 million.

Top Retailers

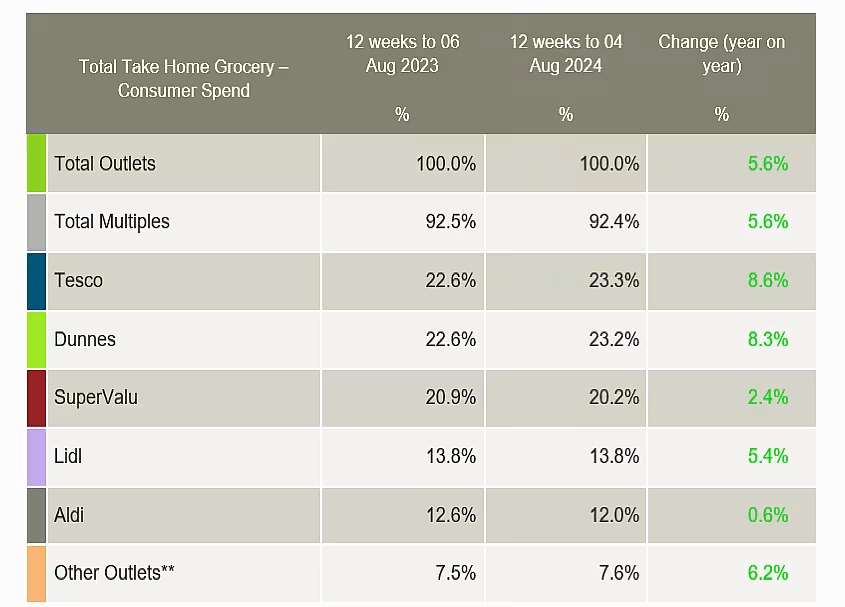

Tesco edged ahead of Dunnes Stores to the position of Ireland's top retailer with a market share of 23.3%, seeing a sales increase of 8.6% year on year.

The retailer's growth was driven by more frequent trips contributing an additional €36.3 million to its overall performance.

With a market share of 23.2%, Dunnes Stores emerged second with year-on-year sales growth of 8.3%.

The retailer was boosted by more frequent shopping trips, up 6.2% year-on-year, which contributed an additional €43.2 million to its overall performance.

SuperValu ranked third with 20.2% of the market. With an average of 21.9 trips a year, shoppers at SuperValu made the most trips in-store when compared to all retailers.

Lidl's market share was 13.8%, with frequent trips contributing an additional €35.2 million to its overall performance.

Aldi's market share stood at 12% with frequent trips contributing an additional €6.9 million to its performance.