Shoppers in Ireland spent €24.6 million on Easter Eggs this year, or €9.3 million more compared to last year, according to the latest data from Kantar.

Sales of hot cross buns, meanwhile, increased 28% year-on-year, with shoppers spending €1.1 million on this traditional Easter treat.

Emer Healy, business development director at Kantar commented, “With Easter on the horizon and Easter eggs hitting the shelves earlier every year, it’s no surprise that Irish consumers have been stocking up on classic seasonal treats.

“During the month of March nearly half of all Irish households purchased Easter eggs, which is up 13.1 percentage points versus last year.”

More than 51% of value sales of Easter eggs were sold on promotion, Kantar noted.

Grocery Sales

Overall take-home grocery sales rose 4.5% in the four weeks to 17 March, with €1.1 billion spent at the checkout, data showed.

Shoppers spent an additional €47.8 million on take-home groceries compared to the same period last year.

The average price per pack rose 4% in March, while volumes per trip fell by 1.2%.

Spending was, once again, driven by grocery price inflation despite an increase in value sales.

Grocery inflation rose 3.7% in the 12 weeks to 17 March 2024, down 16% versus March 2023.

Healy stated, “This is the eleventh month in a row that there’s been a drop in inflation, which will be very welcome news for consumers.

“While it’s the lowest inflation level we have seen for two years, shoppers in Ireland are still on the hunt for value with over 25% of value sales coming from promotions.”

Other Trends

Sales of own-label products grew ahead of the total market at 5.5% year-on-year, while the value share of private-label in the period stood at 48%.

Shoppers spent an additional €80.5 million on store brands in the period, with the premium own-label ranges seeing growth of 12.3% year on year, with shoppers spending an additional €172 million.

Sales of branded goods increased 3.8% year on year, slightly behind the overall market.

The online channel saw 16.7% year-on-year growth in sales as shoppers spent an additional €26.5 million.

New shoppers, alongside larger trips, boosted online’s overall performance by €16.3 million, Kantar added.

Top Retailers

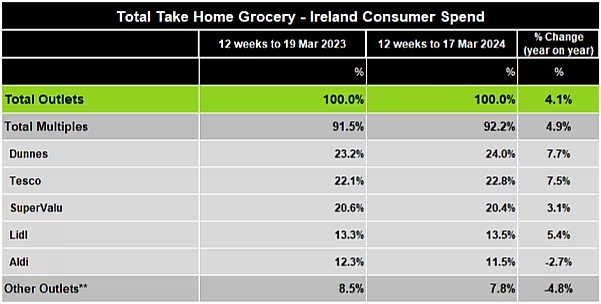

Dunnes Stores emerged as Ireland's top retailer with close to a quarter of the market share (24%) and year-on-year growth of 7.7%.

Growth was driven by a 5.4% increase in trips which contributed an additional €38.2 million to the retailer's overall performance.

Tesco placed second with 22.8% of the market, up 7.5% year-on-year.

The retailer saw the strongest frequency growth amongst all the retailers for another month in a row, which contributed an additional €50.8 million to its overall performance, Kantar noted.

SuperValu saw the highest number of in-store trips (21.3 on average), meanwhile, to acquire 20.4% of the market.

Lidl's market share stood at 13.5%, up 5.4% year on year, while Aldi was at 11.5% as more frequent trips contributed an additional €6.4 million to its overall performance.