Irish shoppers spent a 'record-breaking' €1.2 billion in December on groceries as households prepared for Christmas, according to the latest data from Kantar.

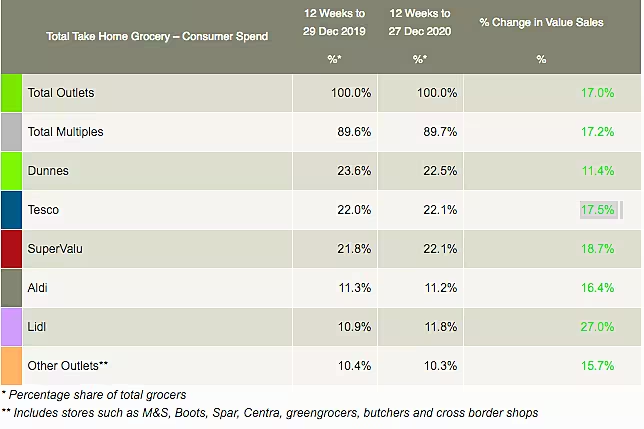

The sales of take-home groceries increased by 17.0% in the 12 weeks to 27 December 2020, data showed.

The average shopper spent €134 more on groceries in December 2020 than they did in the same period in 2019.

Almost half of the Irish population hit the supermarkets on 23 December, making it the busiest shopping day of the year.

Emer Healy, retail analyst at Kantar, commented, “Christmas was certainly different this year, but pared back festivities didn’t stop Irish families from looking for ways to keep spirits high.

“Even though there was a temporary easing of restrictions on eating and drinking out in December, most of us still turned to the supermarkets to provide some sorely-needed festive cheer.”

Major Trends

Shoppers spent approximately €1.2 million less on whole turkeys over the four weeks to 27 December, compared to the same period last year.

Irish shoppers opted for smaller cuts of meat and spent €938,000 more on turkey rolls, €398,000 extra on roast beef, and an additional €480,000 on roast pork.

Healy added, “Our collective sweet tooth saw an extra €6.7 million spent on chocolate confectionery this December.

“We also parted with €3 million extra on cheese and, as we all raised a glass to the end of 2020, alcohol sales soared by 33%.”

Lidl saw 70% growth in alcohol sales in the three months leading up to Christmas, the study found.

The sales of branded products generated an additional €1.6 billion in 2020, with sales of premium private-label items increasing by 17.8% in the most recent twelve weeks.

Aldi reported ‘strong sales’ of branded goods, with shoppers spending an additional €11.6 million on well-known labels.

Online sales generated sales worth €133 million in the latest 12-week period. Digital orders accounted for 4.1% of all grocery sales in December, up from 2.8% in December 2019.

Top Retailers

Dunnes Stores emerged as Ireland’s top retailer during the period, with a 22.5% market share and sales growth of 11.4%.

Lidl witnessed the highest sales growth of 27.0% in this period, with the discounter holding a market share of 11.8%.

Tesco and SuperValu were the country’s second-biggest grocers, with both holding a market share of 22.1%.

SuperValu recorded sales growth of 18.7%, while Tesco saw sales growth of 17.5%.

Aldi witnessed sales growth of 16.4% with the discounter holding a market share of 11.2%

© 2021 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: The European Supermarket Magazine.