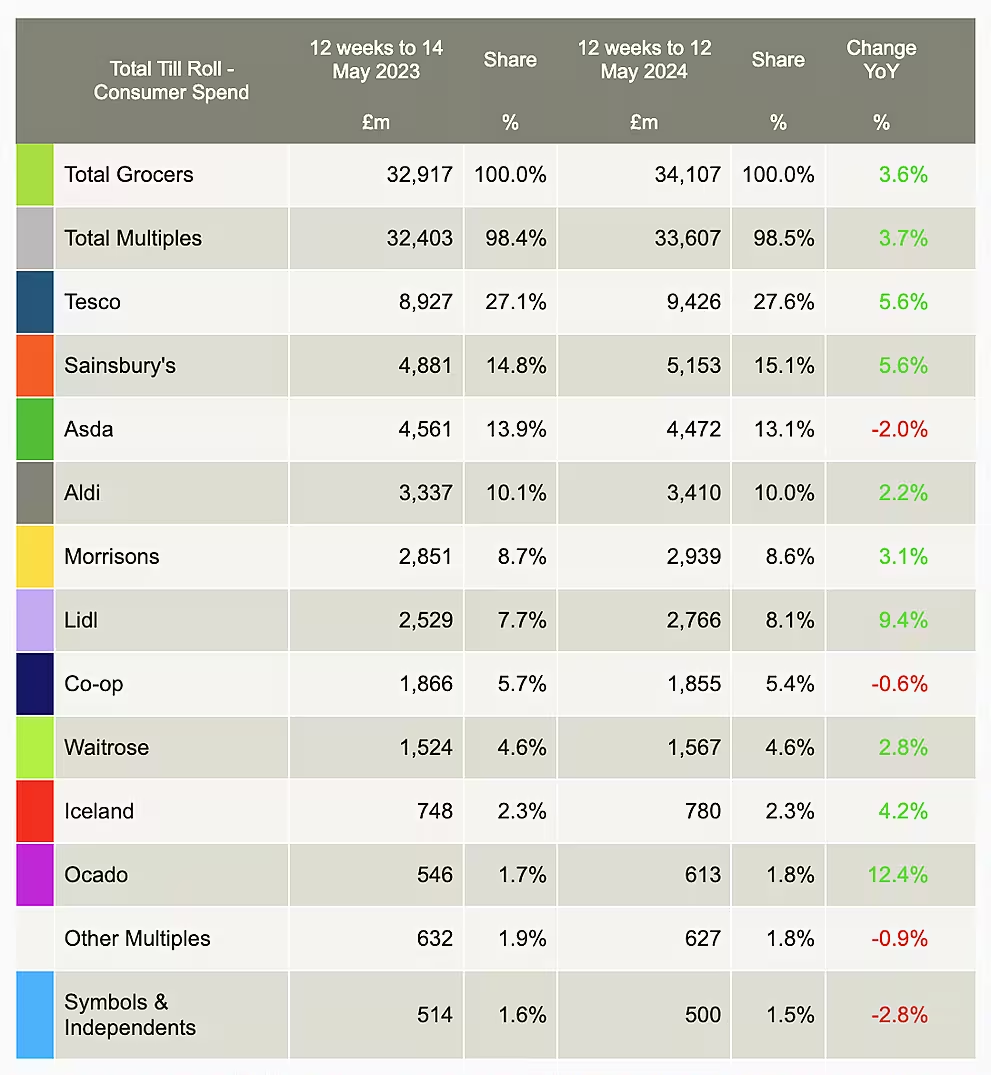

Discounter Lidl has hit a new record share in the UK grocery market, reaching 8.1%, new data from Kantar has shown.

Kantar's grocery market share data for the 12-week period to 12 May, indicates that Lidl reported a 9.4% increase in sales compared to the corresponding period last year, while rival Aldi (10.0% market share) saw sales increase 2.2%.

Lidl's performance was driven by both its in-store bakery options – with freshly baked bread, cakes or pastries making it into a quarter of baskets – and its Lidl Plus app, which has helped boost volume sales.

Top Performers

Ocado was the fastest-growing grocer over the 12-week period, Kantar said, with sales rising 12.4%. Ocado accounts for 1.8% of the overall grocery market, or 3% in London.

Tesco, the UK's biggest grocer, has gained 0.5 percentage points in market share since the same period last year, putting it on 27.6% for the 12 weeks to 12 May. Tesco saw its sales increase 5.6% year-on-year, as did rival Sainsbury's, which holds 15.1% of the market.

Asda, in third (13.1% market share) reported a 2.0% decline in sales compared to last year, however.

Inflation Continues To Decline

Elsewhere, grocery price inflation has fallen for the fifteenth month in a row in the UK, to currently stand at 2.4%, its lowest level since October 2021.

“Grocery price inflation is gradually returning to what we would consider more normal levels," commented Fraser McKevitt, head of retail and consumer insight at Kantar. "It’s now sitting only 0.8 percentage points higher than the 10-year average of 1.6% between 2012 and 2021, which is just before prices began to climb.

“Typically, an inflation rate of around 3% is when we start to see marked changes in consumers’ behaviour, with shoppers trading down to cheaper items when the rate goes above this line and vice versa when the rate drops. However, after nearly two and a half years of rapidly rising prices, it could take a bit longer for shoppers to unwind the habits they have learnt to help them manage the cost of living crisis."

McKevitt noted that private-label ranges continue to grow faster than brands, accounting for more than half (52%) of total spend. Premium own-label ranges also continue to gain ground, rising by 9.9% compared to the year ago.