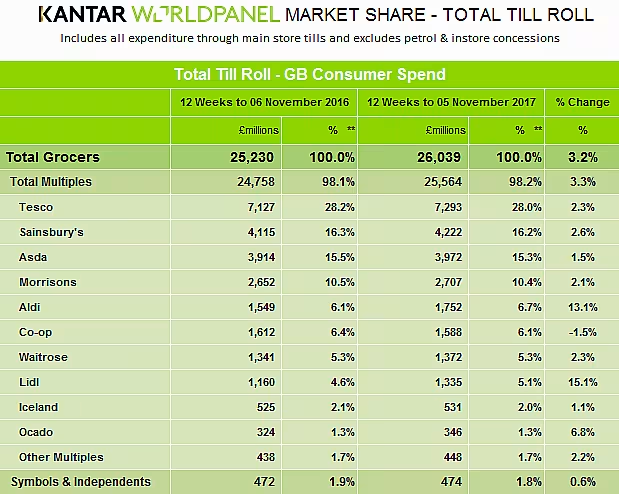

The latest Kantar Worldpanel market share figures have found that Lidl is now the fastest growing UK supermarket for the fifth consecutive period in a row, with sales rising 15.1%.

According to the figures, for the 12 week period to 5 November, the discounter now stands on 5.1% market share, putting it within touching distance of Waitrose, which holds 5.3% share.

‘New store openings – and the opportunity they bring to attract new shoppers – have contributed to [Lidl’s] impressive performance,’ Kantar Worldpanel said. ‘Some 10.6 million households visited Lidl at least once during the past three months.’

Elsewhere, rival discounter Aldi has consolidated its position as the UK’s fifth largest supermarket, holding 6.7% market share, after seeing a 13.1% rise on last year.

Market Leaders

Tesco retains its position as UK market leader, with 28% share (up 2.3%), while all the rest of the ‘Big Four’ all saw gains compared to last year, with Sainsbury’s up 2.3% (the retailer sits on 16.2% market share), Asda up 1.5% (15.3% market share) and Morrisons up 2.1% (10.4% market share).

On Sainsbury’s performance, Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, said, “Brands were the fastest-selling products at Sainsbury’s during the past 12 weeks – particularly in soft drinks and dairy – flying in the face of the market’s focus on own-label lines. The grocer’s strongest growth came from both its Local convenience stores and online sales.”

Asda saw its eighth period of growth, its longest run of sales since March 2014. “Both cheaper and more premium own label lines delivered an impressive performance to help increase overall sales by 1.5% year on year,” said McKevitt. “Asda’s budget Farm Stores range grew by 88%, while sales of its Extra Special line were up 22%. The grocer will be looking to build on this growth over Christmas and well into the new year.”

Inflation

Kantar Worldpanel’s figures also found that like-for-like grocery inflation now stands at 3.4% – its highest level since November 2013. The research company said that over the course of a year, this could add £143.70 to a typical family’s grocery bill.

“With the average shop currently costing £18.26, consumers are now paying an extra 62 pence each time and over the course of a year it could add £143.70 to a typical family’s grocery bill,” added McKevitt.

© 2017 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.