Marks & Spencer's current stock market valuation means that the retailer 'looks doomed to automatic relegation' from the blue-chip FTSE 100 index, a leading analyst has said.

Russ Mould of AJ Bell was commenting ahead of a planned reshuffle to the index in the coming days, which is likely to see M&S slip back into the FTSE 250 index.

Stock Market Reshuffle

“We have already had four changes to the FTSE 100’s make-up in 2019, and further changes look likely at the reshuffle that will take place based on stock market valuations at the close on Tuesday 3 September," Mould said.

"Marks & Spencer’s modest £3.5 billion (€3.87 billion) stock market valuation means it looks doomed to automatic relegation and that would end the retailer’s membership of the index, which dates right back to the launch of the FTSE 100 in 1984."

Energy firm Centrica and insurer Direct Line are also poised for relegation from the FTSE 100, however it is M&S that is likely to "really catch the eye if it slips through the trapdoor", according to Mould.

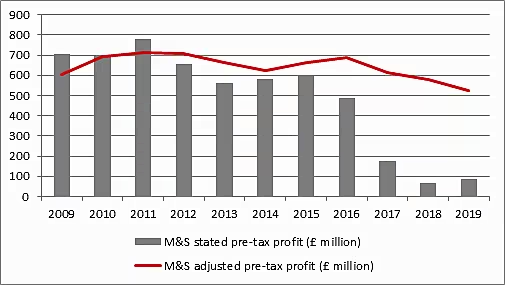

"The management team of Archie Norman and Steve Rowe continue to insist that the company is changing quickly and the all of the right pieces are in now in place to halt and then reverse a steady erosion of the company’s annual profits since 2011 (or even 2007, when pre-tax profit reached £1.1 billion)," he added.

Longstanding Presence

Marks & Spencer is just one of 28 firms to have retained its position in the FTSE 100 since its formation in 1984, and one of only 16 firms to still trade under the same name as it did 35 years ago.

"M&S’ demotion would therefore leave just 27 of the original 100 members in the index in a similar form, with the same or a new name, to show just how hard it is for companies to stay at the top for very long," said Mould.

The analyst said that the combination of a 'grinding' multi-year profit decline, drops in like-for-like sales in both food and general merchandise, and 'investor scepticism' over its joint venture with Ocado has eroded Marks & Spencer's market value.

"May’s full-year results revealed a ninth consecutive quarter of like-for-like sales decline in Food and Clothing (and therefore at group level) as investors are clearly becoming impatient with chief executive Steve Rowe, who took over in April 2016 and has since sanctioned £1.4 billion in restructuring, store closures and other exceptional costs," Mould added.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones, graph by AJ Bell. Click subscribe to sign up to ESM: The European Supermarket Magazine.