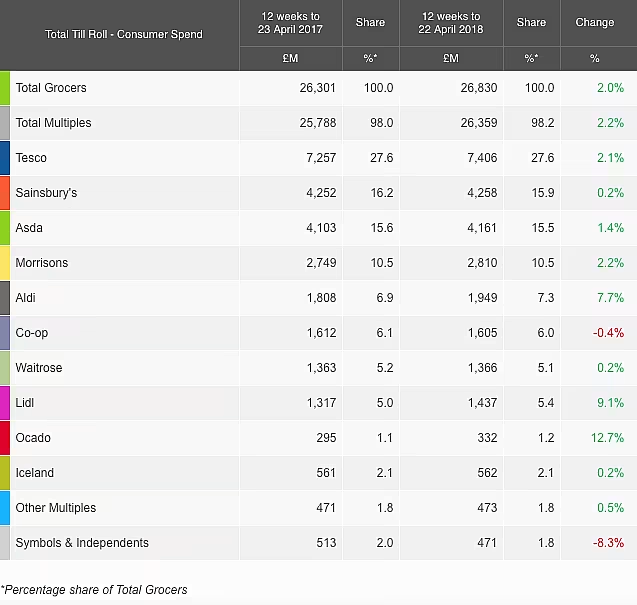

Sainsbury's and Asda, the two British supermarkets planning to merge, had the slowest sales of the Big Four chains in the 12 weeks to 22 April, market data showed on Tuesday.

Sales at number-two ranked Sainsbury's rose by 0.2%, while Asda, owned by Walmart, saw growth of 1.4%, Kantar Worldpanel said.

Both Sainsbury's and Asda dropped market share compared to a year ago – down 0.3 percentage points and 0.1 percentage points, respectively, Kantar said.

'Pivotal Moment'

Current market leader Tesco posted sales growth of 2.1%, while sales at fourth-placed Morrisons were up 2.2%. Market share for both was flat, at 27.6% and 10.5%, respectively.

"This is a pivotal moment for the British grocery market," said Fraser McKevitt, head of retail and consumer insight at the research company.

"A merger between Sainsbury's and Asda would transform the traditional landscape, placing nearly a third of market share in the hands of the joint supermarket giant, though the march of the discounters – and any enforced store closures – could impact this figure," McKevitt added.

The strongest growth in the bricks-and-mortar supermarket sector continued to come from the German discounters, Aldi and Lidl.

Sales at Aldi rose by 7.7%, giving it a market share of 7.3%, while growth at Lidl was 9.1%, taking its share to 5.4%.

Online supermarket Ocado was the biggest mover, however, with sales up by 12.7%. Its share of the market rose by 0.1 percentage point, to 1.2%.

Graphic sourced from Kantar Worldpanel.

News by Reuters, edited by ESM. Click subscribe to sign up to ESM: European Supermarket Magazine.