M&S Bank is transforming its product and service offering to facilitate digitally-enabled shopping and payment experience for customers.

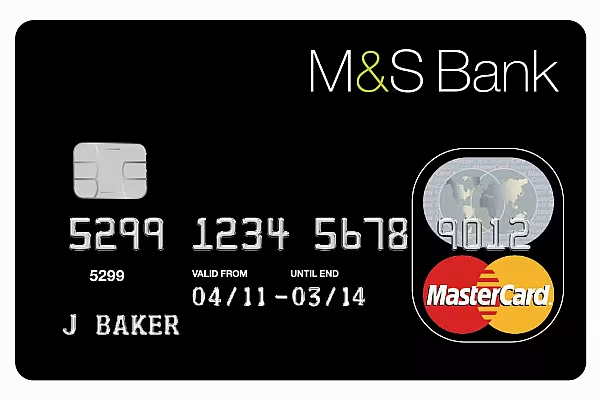

The new-look service, scheduled to launch this summer, includes a new reward credit card offering and digital payment solution for M&S' Sparks customer base.

The new reward card offering will enable customers to access a range of new and digitally-focused benefits, specifically designed to cater to customers' needs.

Similar to the relaunch of Sparks by M&S in July 2020, which added over 2 million new customers to the service, the new credit card offering has been built around customer feedback and will be available to existing and new customers.

Digital Credit Option

M&S Bank will also launch a digital credit option later this year to offer an easier payment solution for Sparks customers.

The payment solution will be available on M&S.com or through the M&S App and expand payment options for customers.

The move follows the recent extension of M&S Bank's popular travel money service to more than 450 M&S stores across the UK.

The service also offers a faster click-and-collect option, allowing customers to order with their smartphones in stores and collecting their purchases in 15 minutes.

Online Servicing

Also included in the revised plan is M&S Bank's decision to offer more online and telephone-based servicing to enable customers to access their accounts at a time that suits them.

As a result of these service changes, it will close its current account offer and 29 associated in-store branches.

However, the retailer said that its in-store travel money bureaux, located in over 100 stores, will remain unaffected.

M&S Bank will also continue to offer its existing range of general insurance, savings, and loan products, the company added.

© 2021 European Supermarket Magazine – your source for the latest retail news. Article by Conor Farrelly. Click subscribe to sign up to ESM: The European Supermarket Magazine.