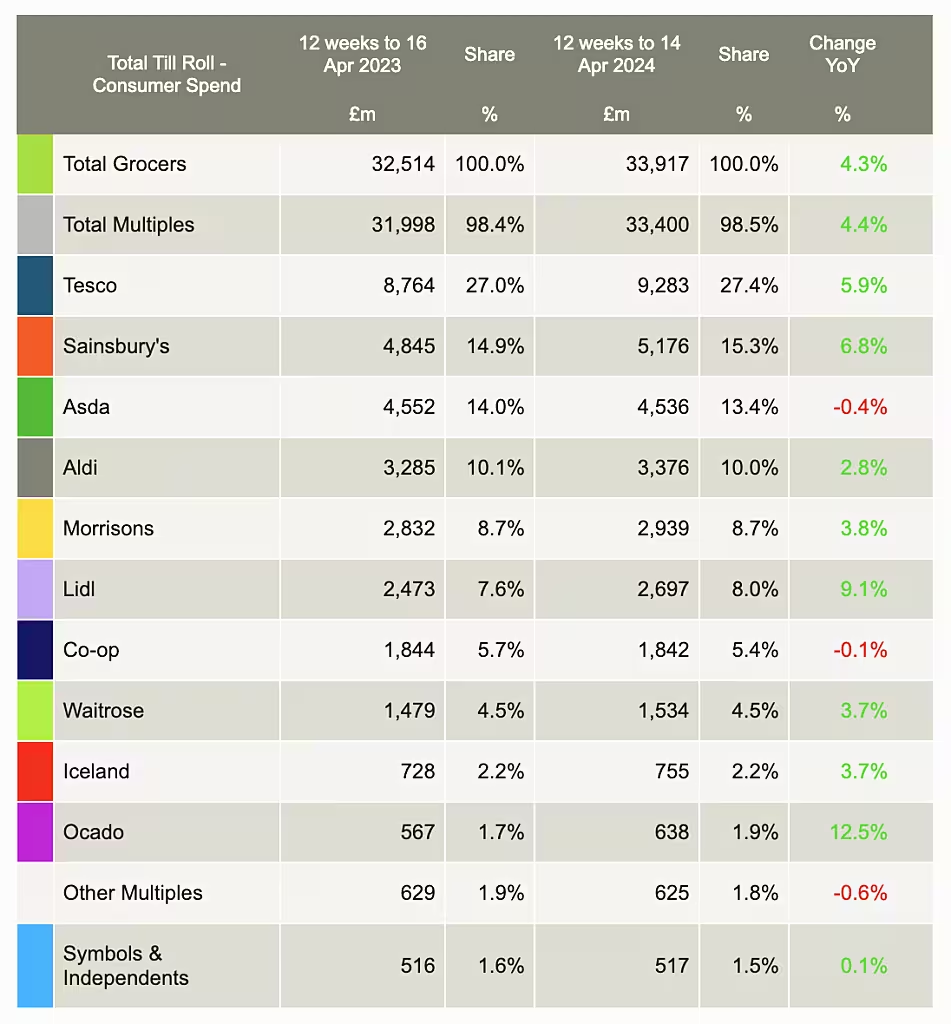

Ocado was the fastest-growing retailer in the UK grocery market in the 12 weeks to 14 April, new data from Kantar has shown, with the online operator seeing 12.5% growth, performing ahead of the total online market.

Online grocery hit its highest level since July 2022 in the period, rising to 12% of the overall market, Kantar said.

Elsewhere, discounter Lidl saw a 9.1% increase in sales, reaching a record 8.0% of the market, while rival Aldi saw its sales rise by 2.8%, reclaiming a market share of 10.0% that it last reached in September 2023.

Tesco, the UK market leader, saw its sales rise by 6.8% to put it on 27.4% market share, while Sainsbury's (15.3% market share) saw sales rise 6.8%. Asda (13.4% market share) reported a 0.4% decline in sales, however.

Grocery Price Inflation

Grocery price inflation fell to 3.2% in the four weeks to 14 April, which was the 14th monthly decline in a row, Kantar's data showed, with promotional spending on the increase.

Some 29.3% of supermarket items were bought on offer in the period, which was the highest level (outside of Christmas) since June 2021.

Take-home grocery sales rose by 3.3% in the four-week period.

Growth In Promotions

“We’ve been monitoring steady annual growth in promotions over the past 11 months as retailers respond to consumers’ desire for value," commented Fraser McKevitt, head of retail and consumer insight at Worldpanel by Kantar.

"Deals helped shoppers save a massive £1.3 billion (€1.51 billion) in the latest four weeks, almost £46 (€53.36) per household. This emphasis on offers, coupled with falling prices in some categories like toilet tissues, butter, and milk, has helped to bring the rate of grocery inflation down for shoppers at the till."