Online grocery sales in Ireland saw growth of over 125% in the 12-week period to 9 August, resulting in a record market share of 4.6% and sales amounting to €75.1 million, according to the latest data from Kantar.

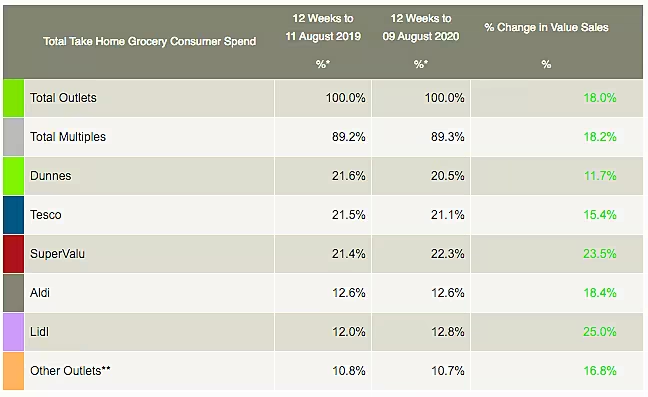

Overall sales of take-home groceries slowed to 18.0% year-on-year during this period as COVID-19 restrictions eased.

In the latest four weeks, Irish shoppers spent €930 million on groceries, the lowest since February, data showed.

'Grocery Spend Is Climbing Down'

Emer Healy, retail analyst at Kantar, commented, “With restrictions on movement and eating out lifting, grocery spend is climbing down from the record-breaking heights we saw in previous months. A year-on-year comparison shows that shoppers still visited stores four fewer times over the 12 weeks, but trends are less stark than they were at the peak of lockdown.

“The relaxing of rules across much of Ireland means shoppers are less inclined to favour large, infrequent shops. People spent approximately €5 less per trip over the past four weeks compared with April, picking up fewer items in store as they start to return to pre-COVID-19 habits.”

Other Trends

Sales of branded groceries saw significant growth in this period as shoppers chose to treat themselves to little luxuries at home, the report noted.

Spending on brands grew by 23.4% to around €245 million, outpacing private label sales.

Sales of logs and firelighters grew by 77% in the past month, as consumers enjoyed barbecues and campfires as part of their staycations.

Healy added, “The bad weather didn’t dampen spirits and sales of firelighters and logs were boosted by people’s new summer plans.

“Hotel breakfasts were swapped for homemade alternatives and eggs, bacon and sausages all grew ahead of the market in the same period.”

Sales of take-home alcohol started to slow down as consumers were more inclined to socialise outside of their homes.

Alcohol sales increased by 56% in the past twelve weeks, which represents a significant decline on the previous month, when sales were up 76%.

Top Retailers

SuperValu claimed the highest market share of 22.3% in the period, followed by Tesco at 21.1%.

SuperValu also emerged as the only retailer to see new shopper numbers increase, contributing another €624,000 to its growth.

Tesco saw sales growth of 15.4%, driven by bigger basket size and higher average prices.

Dunnes Stores posted a market share of 20.5%, driven by an increase in volumes and the highest average spend per trip.

Lidl’s market share stood at 12.8%, which its highest to date, the report said.

Aldi reported the highest sales growth (18.4%) in this period and a market share of 12.6%.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: The European Supermarket Magazine.