Retailers in Europe and the US could be at least two years away from returning to the sort of profit levels they enjoyed in 2019, a new report by Moody's has found.

The report, Pandemic is forcing retail to accelerate its transformation, found that many retailers have 'scrambled to adapt' as margin pressures have escalated, with even the supermarket sector not immune to a drop in operating margin.

Online Shopping Adoption

'As change moves like a wild fire through US and European retail, fuelled by the COVID-19 pandemic, companies are scrambling to adapt,' Moody's said.

'The pandemic has created hordes of online shopping converts, which in turn has ignited record online spending and delivery costs. Many US and European retailers are just starting to calculate the implications of this shifting landscape and are still at least two years away from regaining 2019 profitability levels. We also expect that in five years, there will be far fewer stores while profit margin pressures will intensify.'

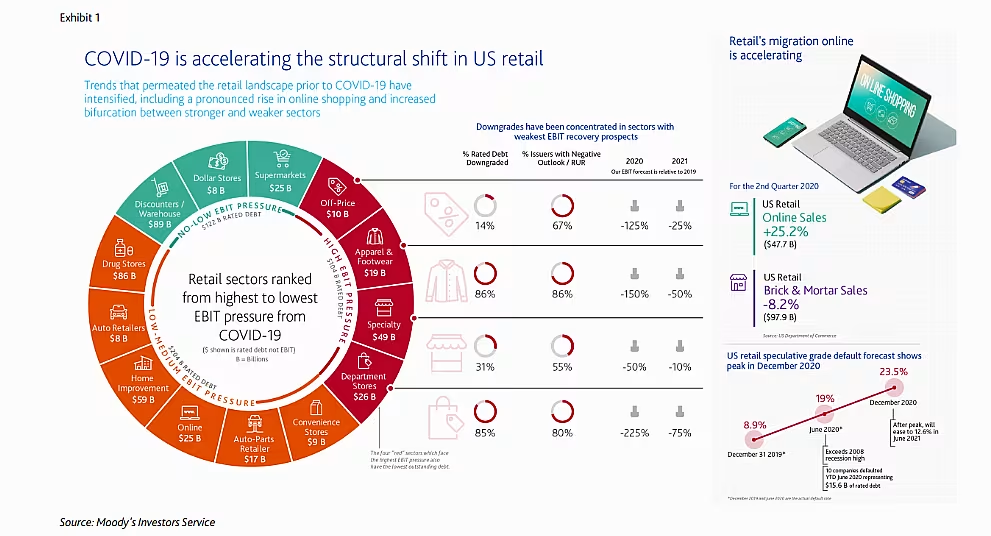

According to the report, the surge in online shopping, driven by the pandemic, is likely to 'forever change' consumer habits, with online growth already having outpaced retail store sales in recent years.

'Stay-at-home orders, which forced most nonessential retailers to close for months, means that a more tech savvy and educated customer is rapidly emerging,' said Moody's.

'In the US and UK at least, we expect online sales as a percent of total retail sales to shoot above 25% over the next five years. Retailers will be forced to find efficiencies and cost reductions to offset the incremental infrastructure to support the expanding demand online.'

This, in turn, is likely to lead to more store closures, particularly in Western Europe, as online's growth impacts the high street. The supermarket and home improvement markets are set to accelerate online spending, it said.

Financial Flexibility

Moody's said that retailers with scale, financial flexibility, and an original product offering are likely to be best positioned to recover – all of these were important factors before the pandemic, and are likely to be even more so afterwards.

'Companies that have proprietary products that inspire customer loyalty, support pricing integrity and minimise promotional activity will be better positioned,' Moody's said.

'Those that have scale and financial clout will prevail while smaller, highly leveraged retailers, many private equity owned, will succumb to performance problems and defaults.'

Shopping malls could prove to be one of the biggest victims of the COVID-19 crisis, with store footprints set to fall by more than 20%, according to Moody's. In the US, it said, that there have long been 'too many stores' in bricks and mortar retail.

'But where previously retailers could live with extra store footage, the abrupt shift in US shopping habits has turned that reality around,' Moodys said. 'We expect many more store closures, including those in stronger malls. Many weaker malls across the US will experience full closures and repurposing to alternative uses for many of these properties.'

Rent Agreements

On the positive side, however, the spate of closures is likely to lead to more realistic rent agreements, with retailers set to be more empowered in the renegotiation of leases.

Lastly, Moody's noted that the giants of retail, such as Amazon, Walmart and Target, are likely to continue to 'set the bar' in areas such as delivery times, cost-effective fulfilment and customer engagement, changes that could 'bode ill' for smaller operators, many of whom may face closure.

'Those left behind, meanwhile, will have the opportunity to transform the remaining landscape,' it said. 'In a post-COVID-19 retail world the “science” required to run a successful retailer will ultimately prevail despite the “art” that will continue to be needed to build strong brands and secure great product.'

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.