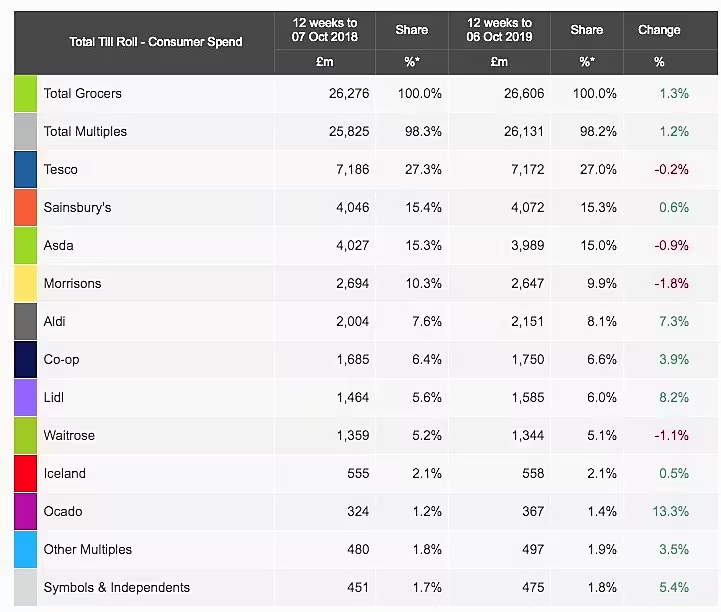

Sainsbury's was the best performing of the UK's 'Big Four' retailers in the 12 week period to 7 October, according to the latest market share data from Kantar.

The retailer posted a 0.6% increase in sales to sit on 15.3% market share, and was the only Big Four retailer to see a sales gain in the period.

Market leader Tesco, which holds 27.0% market share, saw a marginal decline in sales in the period (-0.2%), while Asda, which holds 15.0%, and Morrisons, which holds 9.9% share, also saw drops, of 0.9% and 1.8% respectively.

On Tesco's performance, Fraser McKevitt, head of retail and consumer insight at Kantar, said, "The announcement that Dave Lewis will depart as Tesco chief executive next year has inspired inevitable reflection on his tenure and it’s worth noting that the retailer’s sales were in freefall when he joined in September 2014 – dropping 4.5% year on year.

"Since then, Tesco’s absolute and relative performance has improved and profitability has returned, but its market share is down from 28.8% at the start of his time there.”

Top Performers

The strongest performer in the period was Ocado, which saw a 13.3% increase in sales to sit on 1.4% market share, while the discounters again put in a strong performance: Aldi saw its sales rise by 7.3% to put it on 8.1% market share, while Lidl saw a 8.2% increase in sales, and now sits on 6.0% market share.

“The discounters now account for a combined 14% of UK grocery sales, which is 0.8% percentage points higher than last year – an increase that’s worth nearly one billion pounds annually," said McKevitt.

"While traditionally known for its own-label ranges, Lidl’s 8.2% growth was boosted by sales of branded goods, which grew twice as quickly. Meanwhile, Aldi grew by 7.3% during the past 12 weeks as it attracted more new customers than any other retailer, with 689,000 additional shoppers."

Other strong performers included The Co-op, which grew at its fastest rate (3.9%) since April, with the retailer now holding 6.6% share.

Grocery inflation stood at 0.8% for the 12-week period ending 6 October 2019, a continuation of the steady price rise in effect since the 12 week period to 1 January 2017.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.