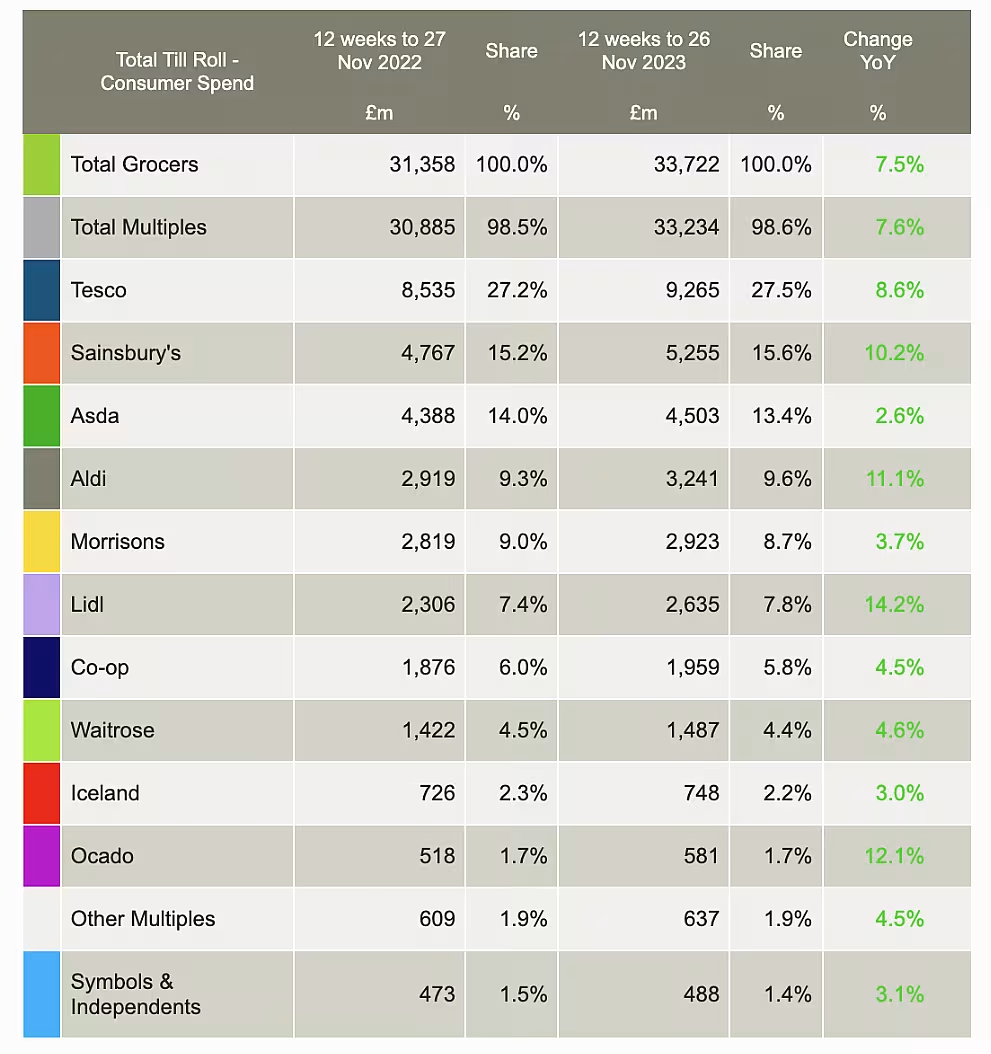

Sainsbury’s has reported its biggest market share jump in a decade, Kantar has noted, with the British retailer seeing a 0.4-percentage-point gain, to 15.6%, in the 12 weeks to 26 November.

The last time that Sainsbury’s reported a share gain of that size was in March 2013, Kantar said, with the retailer’s performance boosted by its private-label offer – sales of its Taste the Difference own-brand range jumped by close to a quarter (23%), year on year.

Overall, Sainsbury’s reported a 10.2% increase in sales, compared to the corresponding period last year.

Best Of The Rest

Market leader Tesco also put in a strong performance, seeing its sales go up by 8.6%, compared to last year, and reporting a market share of 27.5%.

Lidl (7.8% market share) was, once again, the fastest-growing grocer, Kantar added, seeing sales go up by 14.2%, year on year, while Aldi (9.6% market share) also saw sales go up by double digits (11.1%).

Also growing ahead of the market was online retailer Ocado, which saw sales go up by 12.1% in the 12-week period. It now sits on a 1.7% market share.

Christmas On The Way

In the four weeks to 26 November, sales grew by 6.3%, to £11.7 billion (€13.66 billion), with shoppers looking forward to the busy Christmas period, Kantar noted.

“The scene is set for record-breaking spend through the supermarket tills this Christmas,” commented Fraser McKevitt, head of retail and consumer insights at Kantar. “The festive period is always a bumper one for the grocers, with consumers buying, on average, 10% more items than in a typical month. Some of the increase, of course, will also be driven by the ongoing price inflation we’ve seen this year.”

Inflation is starting to show signs of easing, the research firm noted, with grocery price inflation falling to 9.1% in November.